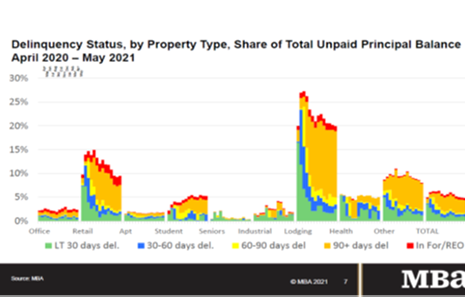

Delinquency rates for mortgages backed by commercial and multifamily properties continue to decline, according to two reports released Thursday by the Mortgage Bankers Association.

Category: News and Trends

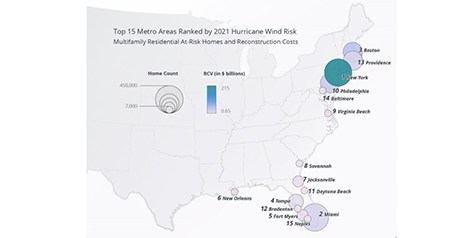

As Hurricane Season Starts, 31 Million Homes ID’d as ‘High-Risk’

June 1 marked the start of the 2021 hurricane season. The National Oceanic and Atmospheric Administration projected another “above-normal” season, with as many as 20 named storms, 6-10 hurricanes and 3-5 major hurricanes (Category 3 or higher).

Quote

“Such restrictions on debt collection practices harm creditors and consumers—particularly consumers who have the greatest need for credit. In short, consumers will suffer under the panel’s decision. While the impacts to the loan servicing industry could be devastating to thousands of Americans employed in it, it will be just as devastating for consumers and their communities.”

–From an MBA/trade group amicus brief in a U.S. Appeals Court case that challenges collections practices under the Fair Debt Collection Practices Act.

Tom Lamalfa: May 2021 MBA Spring Conference Survey

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008.

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations.

Zaid Shariff of SLK Global Solutions: Avoiding CFPB Regulatory Actions by First Cutting Complaints

Zaid Shariff is vice president – head of solution design and product implementation for SLK Global Solutions, Dallas, a provider of digital platforms and business process management solutions to the banking, mortgage and financial services industries.

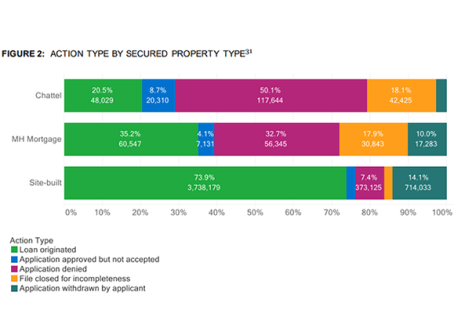

CFPB: Manufactured Housing Loan Borrowers Face Higher Interest Rates, Risks, Barriers to Credit

The Consumer Financial Protection Bureau said manufactured housing can be an affordable but potentially risky avenue for homeownership.

To the Point with Bob–IMBs and the CRA: A Misguided Match

In this edition of To the Point with Bob, MBA President & CEO Robert Broeksmit, CMB, says while the Community Reinvestment Act serves an important policy objective, it is inappropriate to apply it to independent mortgage banks.

MBA Nominates Mark Jones of Amerifirst Home Mortgage as 2022 MBA Vice Chairman

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

2nd Quarter ‘Zombie’ Foreclosures Up 21%

ATTOM Data Solutions, Irvine, Calif., released its second-quarter Vacant Property and Zombie Foreclosure Report, showing 1.4 million residential properties in the United States were vacant in the second quarter quarter, representing 1.4 percent of all homes.