CFPB: Manufactured Housing Loan Borrowers Face Higher Interest Rates, Risks, Barriers to Credit

Chart courtesy of CFPB

The Consumer Financial Protection Bureau said manufactured housing can be an affordable but potentially risky avenue for homeownership.

“Manufactured housing is a small segment of the overall housing supply, but it is one of the most affordable types of housing available to low-income consumers,” CFPB said in a new report, Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data. It noted manufactured housing now makes up 13 percent of the housing stock in small towns and in rural America.

“Those low acquisition costs, however, often come coupled with higher interest rates and limited opportunity to refinance,” the report said. “Consumers who do not own the underlying land are more likely to see their homes depreciate and have fewer protections if they fall behind on payments.”

CFPB Acting Director Dave Uejio noted the Home Mortgage Disclosure Act started gathering manufactured housing data starting in 2018. “This report shows the power of the expanded Home Mortgage Disclosure Act data collection to understand the path to homeownership for some of our most vulnerable families, including Black, Indigenous and Hispanic families, as well as rural and lower-income families of all races and ethnicities,” he said. But more work needs to be done to understand how to ensure that manufactured housing homeownership can be a path to financial stability for the rural and lower-income families who depend on it, he said.

Among the report findings:

– More than 40 percent of manufactured home purchase loans are “chattel” loans, which are secured by the home but not the land. In general, chattel loans have higher interest rates and fewer consumer protections than mortgages. Consumers may choose to get chattel loans to avoid putting the underlying land at risk if they default on the loan.

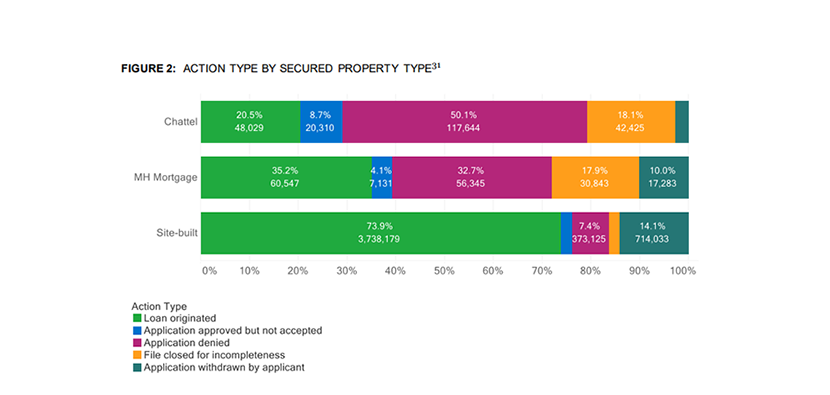

– Most manufactured home loan applications are denied, and less than 4 percent of chattel originations were for refinances. Homeowners seeking a loan on a site-built home are approved more than 70 percent of the time, but less than 30 percent of manufactured home loan applications are approved. At the same time, even during 2019’s low interest rates, very few manufactured housing loans were refinance loans, CFPB found.

– The top five lenders account for more than 40 percent of manufactured housing purchase loans and nearly 75 percent of chattel lending. The four largest originators are specialty lenders that primarily offer chattel loans to manufactured housing owners, CFPB found. Over time, non-bank lenders have played an increasing role in the manufactured housing lending market, while banks have decreased their activity or exited the market altogether.

– Hispanic, Black and African American, American Indian and Alaska Native and elderly borrowers are more likely than other consumers to take out chattel loans, even after controlling for land ownership, the report said. Black and African American borrowers are the only racial group that are underrepresented in manufactured housing lending overall compared to site-built, but overrepresented in chattel lending compared to site-built.