The Consumer Financial Protection Bureau on Nov. 16 issued a Request for Information seeking input on rules implementing the Home Mortgage Disclosure Act.

Category: News and Trends

FHFA Releases 2022 Scorecard for GSEs, CSS

The Federal Housing Finance Agency on Wednesday released its 2022 Scorecard for Fannie Mae, Freddie Mac and Common Securitization Solutions LLC.

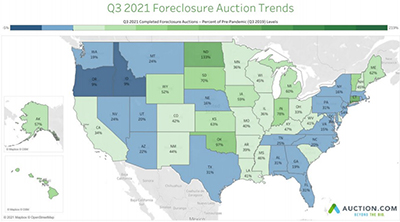

3Q Home Auction Prices Up 15%; 3 in 5 Consumers Would Consider Buying Home at Auction

Strong demand for distressed properties lifted the average sale price at foreclosure auction to an eight-year high and generated surplus funds above total debt owed for nearly half of homes sold at foreclosure auction in the third quarter, said Auction.com, Irvine, Calif.

Redfin: Investors Bought Record 18% of 3Q Homes for Sale

Redfin, Seattle, said real estate investors bought a record 18.2% of the U.S. homes purchased during the third quarter, up from a revised 16.1% in the second quarter and 11.2% a year earlier.

Quote

“The tremendous work that independent mortgage companies, banks, and credit unions have done to help borrowers stay in their homes despite the severe disruption in employment and income should not be overlooked. A reason for the success thus far has been the lessons we all learned from the last financial crisis, not the least of which is the importance of clear, honest communications between borrower and servicer.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

FHA Actuarial Report: Capital Ratio Grows to 8.03%; HECM Ratio Positive for First Time Since 2015

HUD on Monday released its fiscal year 2021 report to Congress on the financial health of the Federal Housing Administration Mutual Mortgage Insurance Fund, showing a nearly 2 percent increase in the fund’s capital ratio to more than 8 percent, well above its congressionally mandated minimum of 2 percent.

3Q Equity-Rich Properties Soar to New Highs

ATTOM, Irvine, Calif., said a record 39.5 percent of mortgaged residential properties in the United States were considered equity-rich in the third quarter.

CFPB, Federal Agencies Rescind April 2020 Joint Statement, Says Will ‘Step Up’ Borrower Protections

The Consumer Financial Protection Bureau and other government agencies on Wednesday announced a return to “enforcement of critical protections” for families and homeowners.

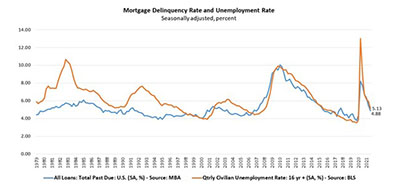

MBA: Mortgage Delinquencies Decline for 5th Straight Quarter

Mortgage delinquencies fell for the fifth straight quarter to well under 5 percent, the Mortgage Bankers Association reported Wednesday.