3Q Home Auction Prices Up 15%; 3 in 5 Consumers Would Consider Buying Home at Auction

Strong demand for distressed properties lifted the average sale price at foreclosure auction to an eight-year high and generated surplus funds above total debt owed for nearly half of homes sold at foreclosure auction in the third quarter, said Auction.com, Irvine, Calif.

In a separate report, ServiceLink, Pittsburgh, said its survey of more than 3,000 consumers found more than three in five consumers (62%) would consider buying a home at auction, with one in 10 (10%) saying they have done so.

Auction.com’s quarterly Foreclosure Market Outlook Report said properties purchased by third-party buyers at foreclosure auction sold for an average price of $167,503 in the third quarter, up 15 percent from the previous quarter and up 42 percent from a year ago to the highest level since Q2 2013 — a more than eight-year high.

The report said surplus funds — foreclosure sales proceeds above the total debt owed to the foreclosing lender that are distributed back to the distressed homeowner after any junior lien holders are paid — were generated for 47 percent of third-party foreclosure sales in the third quarter. That was up from the previous quarter and a year ago to a new pandemic high. The average surplus fund amount rose to was $44,659, up from $34,494 in the previous quarter to the highest amount since Q2 2013.

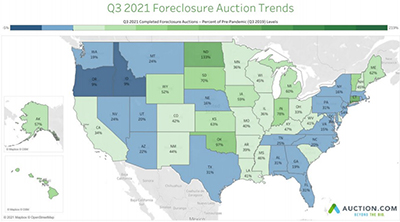

The report noted, however, although foreclosure auction volume rises to new pandemic high in the third quarter, they remain 68 percent below pre-pandemic levels. It also noted forward-looking foreclosure inflow increases to pandemic high, signaling continued increases in fourth quarter and early 2022.

Other report findings:

–80 percent of foreclosure buyers were local, purchasing within 100 miles of their homes.

–47 percent of foreclosure sales generated surplus funds that can be distributed back to distressed homeowners.

–71 percent of renovated foreclosures are resold to owner-occupants.

–Renovated foreclosure resales increase property values by 55 percent on average.

–Renovated foreclosures resell at an average price point that is 26 percent below all retail home sales, providing affordable inventory to local owner-occupant buyers.

–States with high foreclosure volume relative to pre-pandemic levels in the third quarter included Oklahoma, Indiana, Michigan, Mississippi and Wisconsin.

–Remote Bid technology is expanding the demand radius for local foreclosure buyers by 49 miles on average by allowing them to bid on multiple foreclosure auctions occurring at the same time in different surrounding counties.

The report noted many homeowners are still protected from foreclosure by mortgage forbearance and by a temporary rule implemented by the Consumer Financial Protection Bureau. The CFPB rule is scheduled to expire at the end of the year.

“The tsunami of foreclosures many feared in the early days of the pandemic has not materialized thanks in large part to the swift and decisive foreclosure protections put in place by government policymakers and the mortgage servicing industry,” said Ali Haralson, President of Auction.com. “While many of those protections are still in place, foreclosure volume is gradually rising as some slowly phase out.”

In a separate report, ServicLink said more homes are expected to hit the auction market in the coming year – creating an additional option for consumers to purchase property, particularly while supply in the market is tight.

The ServiceLink survey of more than 3,000 consumers conducted online by The Harris Poll said despite the opportunity for greater awareness, consumers are open to buying homes at auction. Although the survey found more than one in four consumers (28%) are not aware that you can buy a home at auction, the majority of those who are aware are ready to buy: more than three in five consumers (62%) would consider buying a home at auction, with one in 10 (10%) saying they have done so.

Millennials (ages 25-40)—many of whom have been at an economic disadvantage in the current housing market environment—appear more apt to consider buying at auction than their older counterparts. Seventy-five percent of millennials say they would consider buying a home at auction, compared to 65% of Gen Xers (ages 41-56) and 54% of baby boomers (ages 57-75). One-fifth (21%) of millennial consumers have bought a home at auction, compared to 13% of Gen Z (ages 18-24), 6% of Gen Xers and 4% of baby boomers.

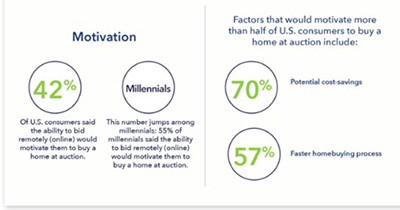

Price and speed appear to be driving factors for consumers when considering buying a home at auction. Potential cost savings (70%) and a faster homebuying process (57%) are motivating factors for more than half of U.S. consumers to buy a home at auction. Alternatively, not being able to see the home in-person prior to buying (66%) and not being able to get a professional inspection (62%) are factors that would stop U.S. consumers from buying at auction.

The survey reported 42 percent of U.S. consumers say the ability to bid remotely (online) would motivate them to buy a home at an auction. For millennials, this jumps to 55%. Younger generations show openness to using remote bidding tools, which can make auctions more accessible, as travel is not necessary in order to participate.

The survey also found consumers anticipate the real estate market will continue to be competitive for potential homebuyers in 2022. Many consumers anticipate the suburbs will continue to thrive, with 41% saying they believe the suburbs will continue to be popular areas for homebuying in 2022, and only 12% believing Americans who left big cities will return to them to live. Nearly half of consumers (45%) expect home prices to increase in 2022, while nearly two-fifths of consumers (39%) believe there will be an increase in foreclosed homes available for purchase at auction in 2022.

“It’s not surprising that millennials are pursuing new opportunities to achieve homeownership, particularly in the current real estate market where they are facing challenges due to high prices and low supply,” said Miriam Moore, president of default services with ServiceLink. “We expect that more auction properties will hit the market next year through foreclosure and buying homes at auction will become more mainstream as consumers look to buy quickly and at competitive pricing.”