ATTOM, Irvine, Calif., reported 19,479 U.S. properties with foreclosure filings in November, down by 5 percent from October but up by 94 percent from a year ago.

Category: News and Trends

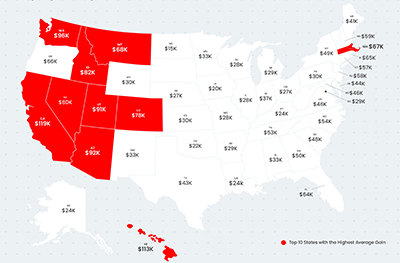

CoreLogic: Homeowners Gained $3.2 Trillion in Equity in Q3

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for 63% of all properties) saw their equity increase by 31.1% year over year in the third quarter, representing a collective equity gain of more $3.2 trillion and an average gain of $56,700 per borrower.

MBA Commends HUD Guidance on Special Purpose Credit Programs

HUD on Dec. 7 released guidance clarifying special purpose credit programs that conform with the Equal Credit Opportunity Act and Regulation B generally do not violate the Federal Fair Housing Act.

MBA, Trade Groups Ask House Approval of Bill Addressing LIBOR ‘Tough Legacy’ Contracts

The Mortgage Bankers Association and nearly two dozen industry trade groups asked House leaders to secure approval of legislation that would address “tough legacy” contract that currently reference the soon-to-be-obsolete London InterBank Offered Rate.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

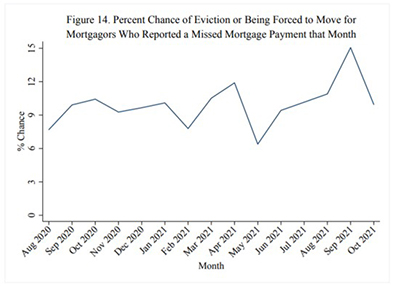

RIHA: More Renters, Fewer Homeowners Missed Housing Payments in September, October

Renters were three times more likely than homeowners to miss payments during September and October, according to updated research released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

Quote

“The overall economic outlook looks brighter but still greatly depends on the course of the virus. Continued job growth and wage gains – especially if they can offset inflation – are key to helping those households that are still facing hardships.”

–Edward Seiler, RIHA Executive Director and MBA Associate Vice President of Housing Economics.

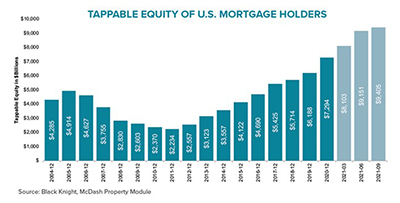

Black Knight: Tappable Equity Surges to Record-High $9.4 Trillion

Black Knight, Jacksonville, Fla., said tappable equity – the amount available for homeowners to access while retaining at least 20% equity in their homes – rose by 32% over the past year, an increase of $2.3 trillion over the past year.

RIHA: More Renters, Fewer Homeowners Missed Housing Payments in September, October

Renters were three times more likely than homeowners to miss payments during September and October, according to updated research released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

MBA, Trade Groups Urge HUD to Issue ‘Clear Roadmap’ for Servicers in LIBOR Transition

As HUD considers changes to its index for FHA-insured adjustable-rate mortgages away from LIBOR, the Mortgage Bankers Association and other industry trade groups urged the Department to issue a clear roadmap for servicers of FHA-insured ARMs, including specification of a replacement comparable index or indices for existing mortgages, as well as guidance on communications with borrowers.