CoreLogic: Homeowners Gained $3.2 Trillion in Equity in Q3

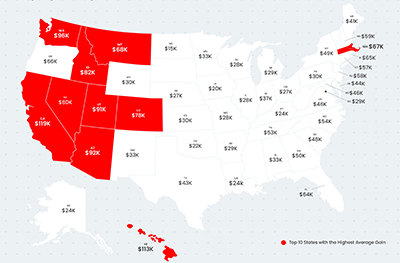

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for 63% of all properties) saw their equity increase by 31.1% year over year in the third quarter, representing a collective equity gain of more $3.2 trillion and an average gain of $56,700 per borrower.

The company’s third quarter Homeowner Equity Report noted home price growth reached the highest level in more than 45 years this past summer, pushing equity gains to another record high and allowing 70,000 properties to regain equity in the third quarter. CoreLogic Chief Economist Frank Nothaft said these equity gains provided a crucial barrier against foreclosure for the 1.2 million borrowers who reached the end of forbearance in September.

“Home price growth is the principal driver of home equity creation,” Nothaft said.

The report said from the second quarter, mortgaged homes in negative equity decreased by 5.7% to 1.2 million homes, or 2.1% of all mortgaged properties. Year over year, homes with negative equity decreased by 28.9%, or 470,000 properties, from 1.6 million homes, or 3 percent of all mortgage properties.

The report said the national aggregate value of negative equity rose to $276.2 billion at the end of the third quarter, up quarter over quarter by $8.2 billion, or 3%, from $268 billion in the second quarter, but down year over year by $8.3 billion, or 2.9%, from $284.5 billion.

CoreLogic said should home prices increase by 5% in the fourth quarter, 145,000 homes would regain equity; if home prices decline by 5%, 191,000 would fall underwater.

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth,” said Frank Martell, president and CEO of CoreLogic. “This financial reserve will be especially helpful for homeowners looking to fund renovation projects.”