Black Knight, Jacksonville, Fla., reported just 0.24 percent of loans in active foreclosure in December, a record low, but cautioned that mortgage delinquency rates remain more than two times pre-pandemic levels.

Category: News and Trends

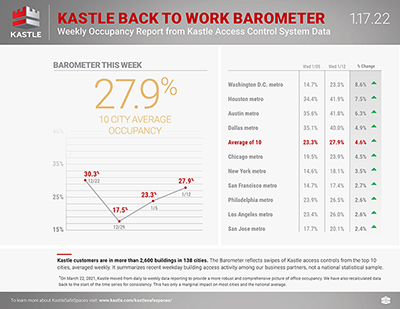

Employers Pause Return-to-Office Plans

Employers are pausing their return to office plans in light of the Delta and Omicron COVID variants, said Yardi CommercialEdge, Santa Barbara, Calif.

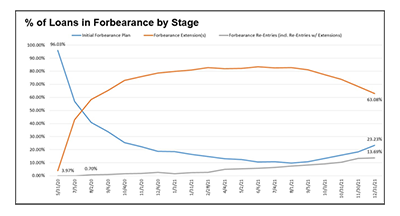

MBA: Share of Mortgage Loans in Forbearance Decreases to 1.41% in December

Loans now in forbearance decreased 26 basis points during December to 1.41% of servicers’ portfolio volume as of December 31, the Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported.

Quote

“It is likely that the remaining borrowers in forbearance have experienced either a permanent hardship that may require more complex loan workout solutions or they have encountered a recent hardship for which they are now seeking relief.”

–MBA Vice President of Industry Analytics Marina Walsh, CMB.

MBA Launches Developing Leaders Mentoring Program; Application Deadline Feb. 4

The Mortgage Bankers Association’s Developing Leaders Mentoring Program is a newly launched 12-month program designed to support development of employees within our member organizations.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

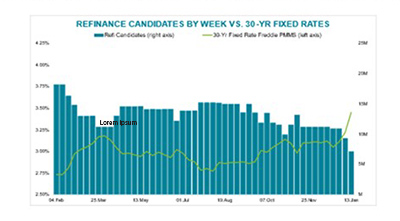

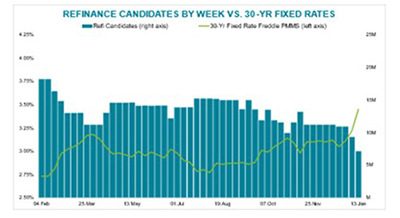

Black Knight: Rising Rates Push Refi Candidates Down to 7.1M

Black Knight, Jacksonville, Fla., said rapidly rising mortgage interest rates have shrunk the number of “high-quality” refinance candidate households to just 7.1 million, the lowest total since November 2019.

MBA Launches Developing Leaders Mentoring Program; Application Deadline Feb. 4

The Mortgage Bankers Association’s Developing Leaders Mentoring Program is a newly launched 12-month program designed to support development of employees within our member organizations.

ATTOM: Foreclosure Activity Falls to Record Low

ATTOM, Irvine, Calif., released its Year-End 2021 U.S. Foreclosure Market Report, which shows foreclosure filings fell to their lowest level since 2005.

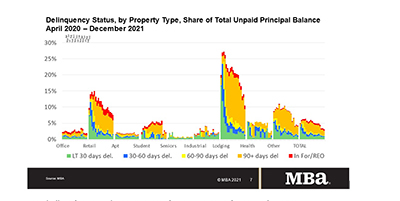

MBA: 4Q Commercial, Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in the final three months of 2021, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.