Employers Pause Return-to-Office Plans

Employers are pausing their return to office plans in light of the Delta and Omicron COVID variants, said Yardi CommercialEdge, Santa Barbara, Calif.

“Some large firms are already tightening safety measures (including Goldman Sachs), while others, such as Apple and Google parent company Alphabet, are holding off on announcing plans until the latest wave of infections settles,” CommercialEdge said in its latest National Office Report.

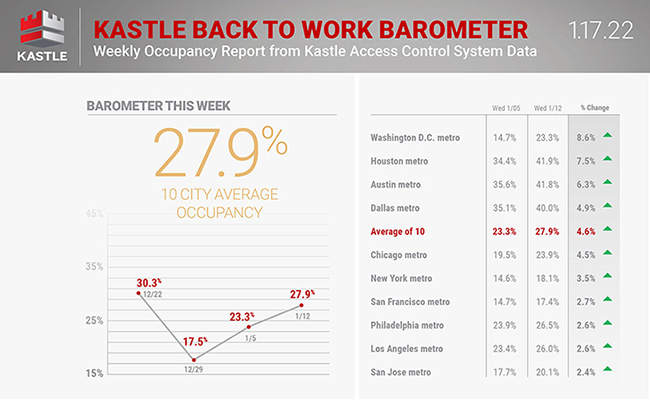

Office monitoring firm Kastle Systems, Falls Church, Va., agreed. Its Back to Work Barometer, which tracks users entering offices in the 10 largest U.S. cities, registered 27.9 percent last week, well below the 40 percent occupancy rate seen in November prior to the Omicron variant.

The office occupancy rate equaled 36.8 percent twelve weeks ago, Kastle noted.

The U.S. office vacancy rate has “stagnated” at 15.5 percent, CommercialEdge said. “Overall, after a few spikes in the first half of 2021, vacancies plateaued in the last six months,” the report said.

CommercialEdge reported the average sale price for office properties in large U.S. markets climbed to $293 per square foot in December as the national sales volume topped $77 billion. But the firm found a dichotomy between offices in central business districts and those within the city center but outside of the CBD. Central business district office prices have fallen 19 percent since the pandemic started to $323 per square foot on average. But prices in non-CBD city center properties increased 28 percent over the past two years.

The under-construction pipeline still represents pre-pandemic trends, CommercialEdge said. More than 155 million square feet of office space was in development at year-end 2021. “But while projects with shovels in the ground are still concentrated in the urban and central business district submarkets, the planned pipeline paints a different picture,” the report said. “Specifically, suburban markets saw a considerable rise in planned developments.” Suburban markets now hold a 48 percent share of the total planned pipeline, up from a 35 percent share of the at the start of 2020.