There is no excerpt because this is a protected post.

Category: News and Trends

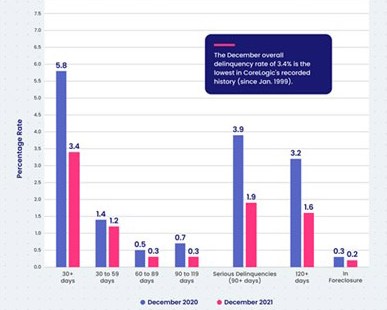

CoreLogic: Mortgage Delinquency Rate Falls to New Low

CoreLogic, Irvine, Calif., said overall mortgage delinquencies fell to their lowest point yet amid improved employment and growing home equity.

Quote

“The invasion of Ukraine is expected to result in instability for some time and could result in escalating cyber risks to our industry. As lending is a critical component of our nation’s infrastructure, we urge our members to remain extra vigilant for attempts to breach their systems through phishing and other attack methods.”

–Rick Hill, Vice President of Industry Technology with the Mortgage Bankers Association.

Regulators, MBA Urge Cybersecurity Vigilance as Worldwide Tensions Escalate

As the Russian invasion of Ukraine escalates and governments worldwide impose economic sanctions, financial regulators have begun to issue guidance in anticipation of potentially heightened cybersecurity attacks and virtual currency disruptions.

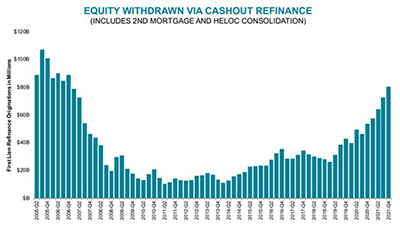

Black Knight: Homeowners Tap Equity at Highest Rate in 16 Years

Black Knight, Jacksonville, Fla., said lenders originated a record 4.4 trillion in 2021, including a record $1.7 trillion in purchase loans.

Rhonda McGill of PerformLine: Marketing Compliance Trends for the Mortgage Industry

Marketing compliance is as important as ever in 2022 for mortgage lenders and servicers, and staying on top of current trends and best practices is key to getting out ahead of regulatory scrutiny.

Fitch: Slowing Trend in CMBS Defeasance

Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

Homeowner Tenure Flattens After 10-Year Rise

The typical American homeowner in 2021 had spent 13.2 years in their home, down slightly from the peak of 13.5 years in 2020 but up significantly from 10.1 years in 2012, said Redfin, Seattle.

Tester, Tillis Introduce LIBOR ‘Tough Legacy’ Bill; MBA, Trade Groups Urge Senate Support

Sens. Jon Tester, D-Mont., and Thom Tillis, R-N.C., on Wednesday introduced a bill that addresses “tough legacy” contracts that currently reference LIBOR. The Mortgage Bankers Association and more than two dozen industry trade groups sent a letter to Senate leadership in support of the bill.

Regulators, MBA Urge Cybersecurity Vigilance as Worldwide Tensions Escalate

As the Russian invasion of Ukraine escalates and governments worldwide impose economic sanctions, financial regulators have begun to issue guidance in anticipation of potentially heightened cybersecurity attacks and virtual currency disruptions.