The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

Category: News and Trends

MBA Selects Philadelphia as its Third CONVERGENCE City

The Mortgage Bankers Association selected Philadelphia as the site for its next CONVERGENCE initiative, a place-based partnership focused on narrowing the racial homeownership gap. CONVERGENCE Philadelphia will launch in early 2023, joining CONVERGENCE initiatives in Memphis, Tenn., and Columbus, Ohio.

MBA: Record-High 1Q Commercial/Multifamily Mortgage Debt Outstanding

Commercial/multifamily mortgage debt outstanding increased by $74.2 billion (1.8 percent) to record levels in the first quarter, the Mortgage Bankers Association reported Thursday in its quarterly Commercial/Multifamily Mortgage Debt Outstanding Report.

Results Mixed on Spring Foreclosure Activity

New reports present a mixed bag on U.S. foreclosures, with CoreLogic, Irvine, Calif., reporting a new low in foreclosure rates, while ATTOM, Irvine, reported an uptick in foreclosure activity.

Fitch: FHFA Final Capital Rules Supportive of Credit for Fannie, Freddie

Fitch Ratings, New York, said the Federal Housing Finance Agency recent adoption of final regulations requiring the submission of annual capital plans and new public risk disclosures for Fannie Mae and Freddie Mac are creditor positive.

Quote

“CONVERGENCE Philadelphia will bring together a local network of housing leaders, non-profits, and other stakeholders to collaborate on sustainable housing opportunities for underserved people and communities. We are grateful for the strong support from Finance of America, Radian and Wells Fargo Home Mortgage as we develop strong affordable housing partnerships to increase homeownership opportunities in Philadelphia.”

–MBA President and CEO Bob Broeksmit, CMB.

MBA, Winnow Solutions LLC Partner to Help Members with Compliance Research, Costs

The Mortgage Bankers Association and Winnow Solutions LLC, Anaheim, Calif., announced a partnership that will provide MBA member subscribers – at a 10% discount rate – a comprehensive database of state and federal regulations to help control costs and better manage the growing complexity of mortgage regulations.

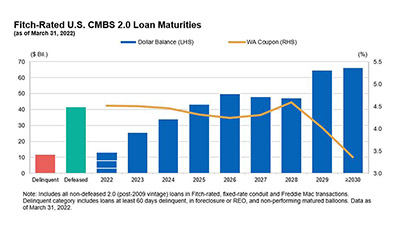

Fitch: Retail Resolutions Drive May U.S. CMBS Loan Delinquency Rate Lower

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

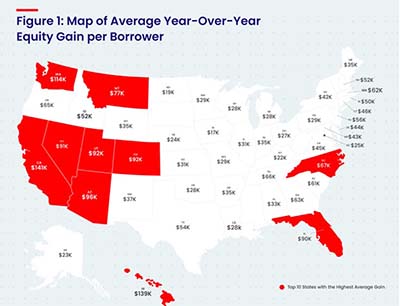

1Q Homeowner Equity Gains Top $60,000 Amid Rapid Home Price Growth

CoreLogic, Irvine, Calif., reported U.S. homeowners with mortgages saw their equity increase by 32.2% year over year, representing a collective equity gain of $3.8 trillion and an average gain of $63,600 per borrower.

MISMO Issues Reporting Guide on Forbearance Data Exchange

MISMO®, the real estate finance industry standards organization, launched a new guide and sample credit response to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.