Results Mixed on Spring Foreclosure Activity

New reports present a mixed bag on U.S. foreclosures, with CoreLogic, Irvine, Calif., reporting a new low in foreclosure rates, while ATTOM, Irvine, reported an uptick in foreclosure activity.

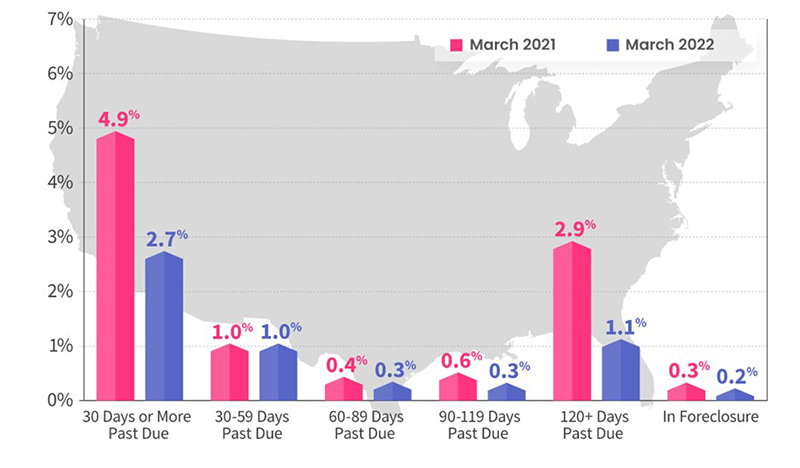

The monthly CoreLogic Loan Performance Insights Report said in March, 2.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 2.2 percentage point decrease from 4.9% a year ago. Key findings:

–Early-Stage Delinquencies (30 to 59 days past due): 1%, unchanged from a year ago.

–Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.4% a year ago.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.4%, down from 3.5% a year ago and a high of 4.3% in August 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% a year ago, matching the lowest foreclosure rate recorded since at least January 1999.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.5%, up from 0.4% a year ago.

CoreLogic reported the national mortgage delinquency rate once again declined year over year and reached another historic low in March, with foreclosure activity following suit. CoreLogic Principal Economist Molly Boesel said a strong job market and income growth continue to drive down the number of property owners who are late on their mortgage payments, while rising home prices and the resulting equity gains are providing alternative options to those who may be coming out of forbearance and/or facing foreclosures.

“The share of borrowers in any stage of delinquency was at an all-time low in the first quarter of 2022,” Boesel said. “However, more than one-third of delinquent mortgages remain six months or more past due on their payments. While we may see an uptick in distressed sales over the coming year, historic home equity gains should keep these sales from reaching elevated levels.”

The report said all states posted annual declines in their overall delinquency rate in March. States with the largest declines were Nevada (down 3.6 percentage points), Hawaii (down by 3.3 percentage points) and New Jersey (down by 3.2 percentage points). The remaining states, including the District of Columbia, registered annual delinquency rate drops between 3.1 percentage points and 0.9 percentage points.

All U.S. metro areas posted at least a small annual decrease in overall delinquency rates, with Odessa, Texas (down 6.3 percentage points); Kahului-Wailuku-Lahaina, Hawaii (down 5.4 percentage points) and Laredo, Texas (down 5.2 percentage points) posting the largest drops.

Meanwhile, ATTOM released its May U.S. Foreclosure Market Report, showing 30,881 U.S. properties with foreclosure filings, up 1 percent from a month ago and up 185 percent from a year ago.

ATTOM said nationwide, one in every 4,549 housing units had a foreclosure filing in May 2022. States with the highest foreclosure rates were Illinois (one in every 2,000 housing units); New Jersey (one in every 2,346 housing units); Delaware (one in every 2,426 housing units); Ohio (one in every 2,667 housing units); and Florida (one in every 2,788 housing units).

“While there’s some volatility in the monthly numbers, foreclosure activity overall is continuing its slow, steady climb back to normal after two years of government intervention led to historically low levels of defaults,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “But with inflation now at a 41-year high, and runaway prices on necessities like food and gasoline, we may see foreclosure activity ramp up a little faster than most forecasts suggest.”

Among the 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in May 2022 were Jacksonville, N.C. (one in every 1,052 housing units); Cleveland, Ohio (one in every 1,389 housing units); Chicago (one in every 1,777 housing units); Fayetteville, N.C. (one in every 1,823 housing units); and Rockford, Ill. (one in every 1,861 housing units).

Those metropolitan areas with a population greater than 1 million, with the worst foreclosure rates in May 2022 including Cleveland, OH and Chicago, IL were: Jacksonville, FL (one in every 1,985 housing units); Orlando, FL (one in every 2,295 housing units); and Miami, FL (one in every 2,432 housing units).

States that had the greatest number of foreclosure starts in May included: Florida (2,483); California (2,238); Texas (2,019); Illinois (1,757); and Ohio (1,285).

“It’s interesting that there were almost ten times more foreclosure starts than foreclosure completions,” Sharga added. “This suggests that financially-distressed borrowers may be finding ways to avoid losing their home to a foreclosure sale.”

ATTOM said lenders repossessed 2,857 U.S. properties through completed foreclosures (REOs) in May, up 1 percent from last month and up 117 percent from last year.