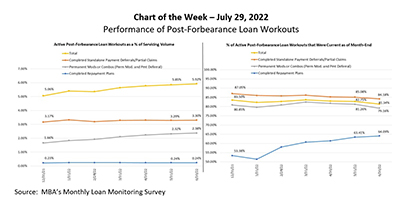

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, from 0.85 percent the prior month. Only about 404,000 homeowners are still in forbearance plans, after reaching a peak of nearly 4.3 million homeowners in May 2020.

Category: News and Trends

ATTOM: 2Q Home Seller Profits Surge

ATTOM, Irvine, Calif., said profit margins on typical home sales hit another record in the second quarter amid the fastest rise in home prices in more than a decade.

New (American) Leader at Top of J.D. Power Mortgage Servicer Rankings

For the first time in nine years, the top-ranked mortgage servicer in J.D. Power’s annual rankings of customer satisfaction is not Rocket Mortgage.

Rhonda McGill of PerformLine: Mortgage Industry Compliance Concerns and Best Practices

PerformLine recently hosted a mortgage industry roundtable that gathered mortgage leaders to discuss best practices for ensuring compliance and consumer protection as we continue into a year of increased regulatory pressure.

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

MISMO Issues Call for Participants for New Workgroup Focused on Standardizing Regulatory Compliance Examination File

MISMO®, the real estate finance industry standards organization, is calling for participants for a new development workgroup focused on defining the standard loan data fields and delivery format that lenders must provide state regulators for the loan portfolio review portion of state examinations.

S&P: Self-Service Residential Mortgage Servicing Increasing

The number of calls per loan to mortgage servicers has decreased as self-service options become more widespread and borrowers can resolve basic requests on their own, reported S&P Global Market Intelligence.

Quote

“Mortgage servicing has always been an opaque experience for customers with the firms originating, owning and servicing the loans often being different and changing over time. In a time when brand reputation, customer trust and customer satisfaction are going to be even more critical for attracting and retaining business, different business models will be put to the test in different ways.”

–Craig Martin, executive managing director and global head of wealth and lending intelligence with J.D. Power, Troy, Mich.

DBRS Morningstar: Solid Credit Performance for Non-QM RMBS

The credit performance of residential mortgage-backed securities backed by non-Qualified Mortgage loans rated by DBRS Morningstar remained steady in the first half of 2022, the ratings firm reported.

8 Common Fair Lending Compliance Myths Debunked

Michael Berman is Founder & CEO of Ncontracts, Brentwood, Tenn. Ncontracts provides integrated risk management and lending compliance software to a rapidly expanding customer base of over 4,000 financial institutions, fintechs and mortgage companies in the United States.