New (American) Leader at Top of J.D. Power Mortgage Servicer Rankings

For the first time in nine years, the top-ranked mortgage servicer in J.D. Power’s annual rankings of customer satisfaction is not Rocket Mortgage.

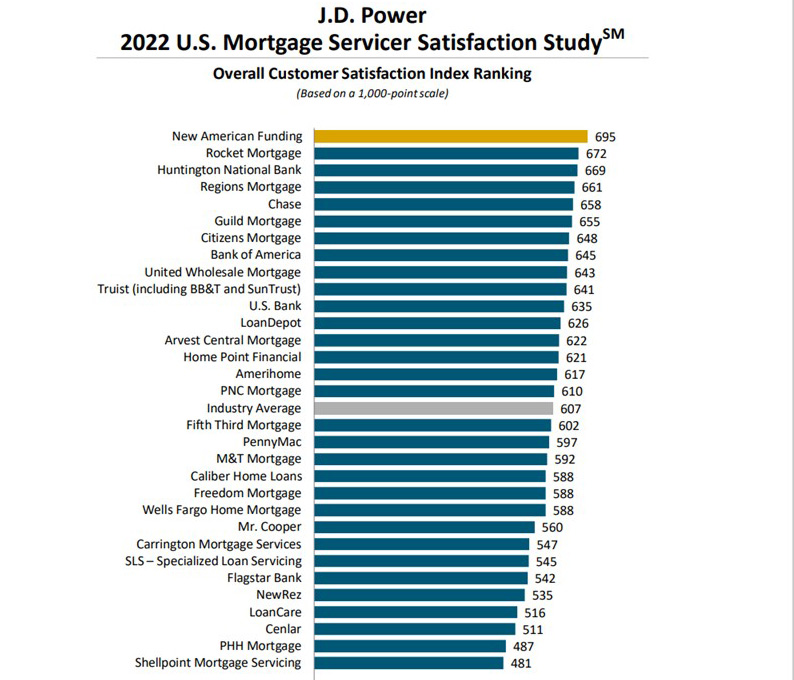

That distinction belongs to New American Funding, Tustin, Calif., which ranked highest with a score of 695 on a scale of 1,000. Rocket Mortgage, Detroit, placed second with a score of 672, followed by Huntington National Bank, Columbus, Ohio, at 669.

The overall satisfaction index for New American Funding was the highest among all 31 mortgage servicers that qualified for publishing in the J.D. Power 2022 U.S. mortgage Servicer Satisfaction Study. The study is based on nearly 8,100 total responses from customers who are asked various questions about their mortgage servicer.

Key findings of the 2022 study:

–Loan transfers hurt satisfaction, erode trust for all parties: Overall customer satisfaction for mortgages that are originated and serviced by the same company is 646 (on a 1,000-point scale). That number drops 133 points to 513 when the mortgage is transferred to a servicer that is different from the originator. Likewise, customer trust in the mortgage servicer falls 145 points to 511 when a loan is transferred vs. those that are originated and serviced by the same company. Critically, the originating firm that made the transfer is affected, too, with only 15% of transferred customers saying they are “very likely” to consider using the original lender in the future.

–Going paperless? Trust matters: More than half (52%) of mortgage servicing customers get a paper statement, but 43% of those customers say their primary means of reviewing their statement is via digital channels, so the paper bill isn’t used. The disconnect often goes back to trust. Among customers who have gone paperless, brand image attributes are rated significantly higher, including “can rely on lender to keep promises” and “lender provides honest communication,” compared with those who do not receive paperless statements. Among those who say they “never will” go paperless, the same brand image attributes are rated significantly lower. Servicers need to understand which customers are open to going paperless and what it will take to convert them.

–Transfers create administrative headaches for customers: More than four in 10 mortgage customers who had a loan transferred say the transfer process was not “very easy.” Among this group, problem incidence is substantially higher (27%) than the problem incidence among customers who say the process was “very easy” (12%). When the transfer process is perceived as “very easy,” satisfaction is 183 points higher than when the process is “somewhat easy,” “somewhat difficult” or “very difficult,” these customers are significantly less likely to need to interact with a live representative. Servicers need to be sure sufficient servicing information is sent from the beginning to better ensure a “very easy” transfer process to improve the customer experience and reduce call volume.

“Mortgage servicing has always been an opaque experience for customers with the firms originating, owning and servicing the loans often being different and changing over time,” said Craig Martin, executive managing director and global head of wealth and lending intelligence with J.D. Power. “In a time when brand reputation, customer trust and customer satisfaction are going to be even more critical for attracting and retaining business, different business models will be put to the test in different ways.”

Martin said servicers that are selling the value of the end-to-end relationship and working to build customer advocates will not succeed if they are satisfied with only being technically proficient. “Even for firms primarily focused on sub-servicing—an area where compliance, efficiency and resource optimization are paramount—it’s critical to realize that customer perceptions heavily influence actions and, as a result, affect the bottom line,” he said.

“Transparency has become the financial services industry’s favorite buzzword for a reason: customers respond favorably when brands communicate their intentions and provide clear guidance on what is happening and why,” said Tom Lawler, head of consumer lending intelligence at J.D. Power. “The complexity of the mortgage industry creates challenges in customer understanding, particularly when it comes to mortgage transfers. We’re entering a market environment where customer satisfaction is going to play a critical role in the success of mortgage brands, and transparency will be a big part of creating the trust that will determine business success.”

New American Funding topped the rankings in its first-ever appearance; in previous years, it did not meet minimum volume levels. In 2020, the company’s servicing portfolio started with 124,000 loans totaling $31 billion. As of July 1, the company’s servicing portfolio had grown to 233,000 loans totaling $61.9 billion, an increase of nearly 88% by loan count and of nearly 100% in total loan value.

“Our business model is built on relationships and the customer experience,” said New American Funding Co-Founder and President Patty Arvielo, noting the percentage of loans made to Hispanic and Black borrowers was 44.8% and 38.2% higher, respectively, than the industry percentage in 2021.