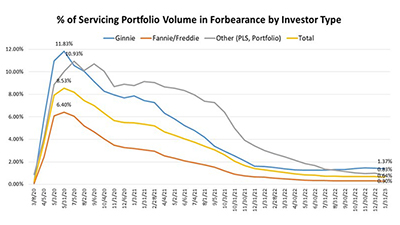

Loans in forbearance decreased by 6 basis points in January to 0.64% of servicers’ portfolio volume as of January 31, the Mortgage Bankers Association reported Tuesday.

Category: News and Trends

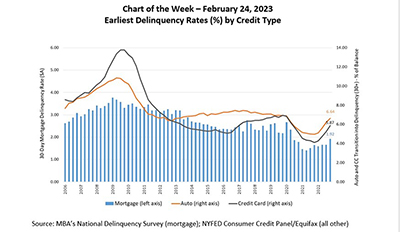

MBA Chart of the Week Feb. 24 2023–Delinquency Rates by Credit Type

The latest credit delinquency data from both MBA and other sources indicates that delinquencies are rising. In MBA’s National Delinquency Survey, covering national and state delinquencies through the fourth quarter revealed that the delinquency rate for mortgage loans on one‐to‐four‐unit residential properties rose to a seasonally adjusted rate of 4.96 percent of all loans outstanding at the end of the fourth quarter.

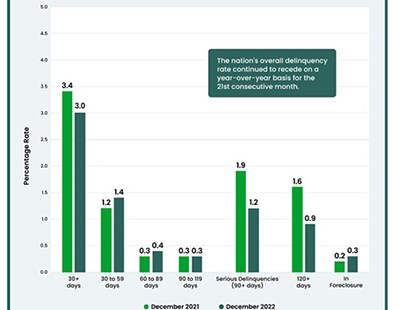

CoreLogic: December Delinquencies Tick Up

CoreLogic, Irvine, Calif., said its leading mortgage performance indicators showed slight increases from previous months but otherwise strong historical numbers.

MISMO Introduces Flood Risk Disclosure Resource Guide

MISMO, the real estate finance industry standards organization, introduced the Flood Risk Disclosure Resource Guide as a resource for borrowers to understand the environmental risks that may be associated with a property before they purchase.

(#MBAServicing23) Market Outlook: A Few Hurdles Ahead

ORLANDO—The mortgage servicing industry has seen a lot of volatility lately—and that’s not likely to ease up any time soon, said Mortgage Bankers Association economists.

Quote: Tuesday Feb. 28, 2023

“The lower premiums will expand homeownership opportunities by lowering mortgage payments for qualified FHA borrowers, providing critical relief from the steep rise in mortgage rates and home prices just in time for the spring buying season. This will especially help minority homebuyers and low-and moderate-income households who are predominantly served by FHA loans.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

#MBA CREF23: Solving America’s Affordable Housing Supply Challenge

SAN DIEGO–The persistent affordable rental housing shortage is growing worse as rents rise faster than incomes in many places, industry practitioners said here at the MBA Commercial/Multifamily Finance Convention & Expo.

#MBA CREF23: Solving America’s Affordable Housing Supply Challenge

SAN DIEGO–The persistent affordable rental housing shortage is growing worse as rents rise faster than incomes in many places, industry practitioners said here at the MBA Commercial/Multifamily Finance Convention & Expo.

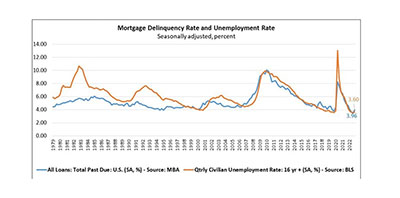

MBA: 4Q Mortgage Delinquencies Increase

Mortgage delinquencies rose to near 4 percent in the fourth quarter, the Mortgage Bankers Association reported Thursday, but remained near survey lows.