CoreLogic: December Delinquencies Tick Up

CoreLogic, Irvine, Calif., said its leading mortgage performance indicators showed slight increases from previous months but otherwise strong historical numbers.

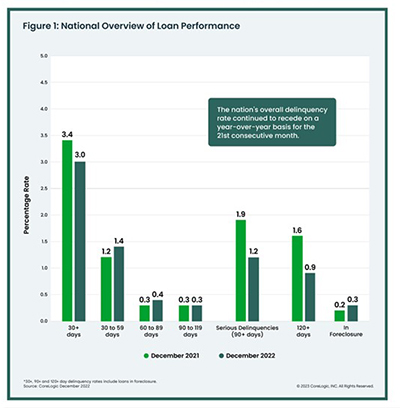

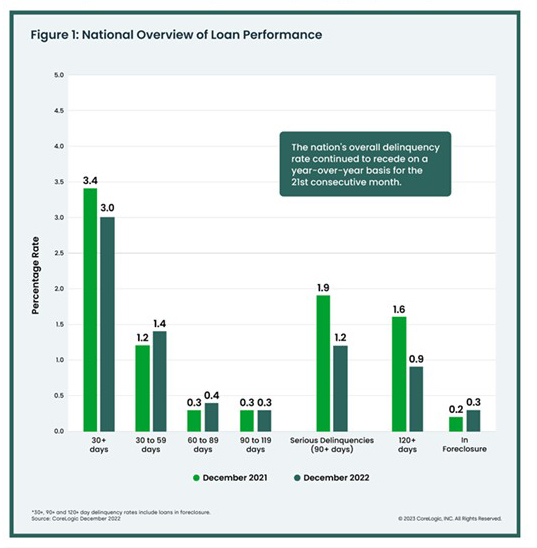

The company’s monthly Loan Performance Insights Report for December showed 3% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 0.4 percentage point decrease from 3.4% a year ago and less than a 0.1 percentage point increase from November.

Other report data:

–Early-Stage Delinquencies (30 to 59 days past due): 1.4%, up from 1.2% in December 2021.

–Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in December 2021.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.2%, down from 1.9% in December 2021 and a high of 4.3% in August 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, up from 0.2% in December 2021.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, up from 0.6% in December 2021.

The report said U.S. mortgage delinquency and foreclosure rates remained consistently low throughout 2022 and closed the year in the same way. December’s 3% overall delinquency rate and the 0.3% foreclosure rate were only slightly higher than numbers recorded over the previous six months. Both types of delinquencies bottomed out in early 2022 and are now showing signs of minor upticks.

The report noted most of that small increase comes from a change in early-stage delinquencies, which began inching up in mid-2022 after hovering near historic lows in the spring of 2021. Still, even with that slight market adjustment, delinquencies remain at the lowest level since the data series began in 1999.

On the other hand, December’s 1.2% serious delinquency rate has barely moved since last spring, which suggests that while some borrowers may have missed several mortgage payments, most are likely to recover relatively quickly.

“Mortgage delinquency rates continued to post some of the strongest performance in three years in December, as a healthy job market helped borrowers remain current on their payments,” said Molly Boesel, principal economist with CoreLogic. “High amounts of home equity cushioned those borrowers who were far behind, keeping them from moving into foreclosure. While there was a small uptick in early-stage delinquencies and foreclosure inventory over 2022, other delinquency measures fell to new lows throughout the year.”

Other report takeaways:

–Only one state posted an annual increase in its overall delinquency rate (Iowa, up by 0.1 percentage point). States and districts with the largest declines were Louisiana (down by 1.1 percentage points); Washington, D.C. (down by 1 percentage point); and Alaska, Hawaii and New York (all down by 0.9 percentage points). The other states’ annual delinquency rates dropped between 0.8 and 0 percentage points.

–65 U.S. metro areas posted an increase in overall delinquency rates, representing 17% of locations that CoreLogic tracks. The top three areas for mortgage delinquency gains year over year were Cape Coral-Fort Myers, Fla. (up by 2.9 percentage points), Punta Gorda, Fla. (up by 2.8 percentage points) and Altoona, Pa. (up by 1 percentage point).

–All but four U.S. metro areas posted at least a small annual decrease in serious delinquency rates (defined as more than 90 days late on a mortgage payment). The metros that saw serious delinquencies increase were Cape Coral-Fort Myers, Fla. (up by 1 percentage point), Punta Gorda, Fla. (up by 0.9 percentage points) and Bloomsburg-Berwick, Pa., and Williamsport, Pa. (both up by 0.1 percentage points). Increases in Florida metros reflect damage caused by Hurricane Ian in September 2022.

Last week, the Mortgage Bankers Association’s Quarterly National Delinquency Survey reported mortgage delinquencies rose to near 4 percent in the fourth quarter, but remained near survey lows.

The NDS reported the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.96 percent of all loans outstanding at the end of the fourth quarter, up 51 basis points from the third quarter but down 69 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter fell by 1 basis point to 0.14 percent.