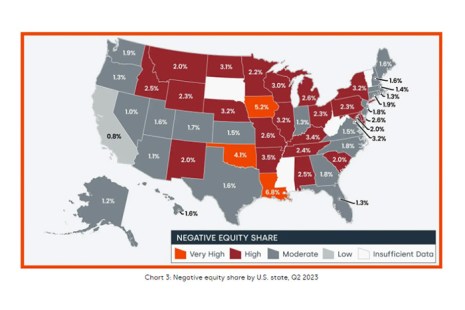

CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the second quarter. While U.S. homeowners with mortgages saw home equity decrease 1.7% year-over-year, they also saw gains from the previous quarter–an average of $13,900.

Category: News and Trends

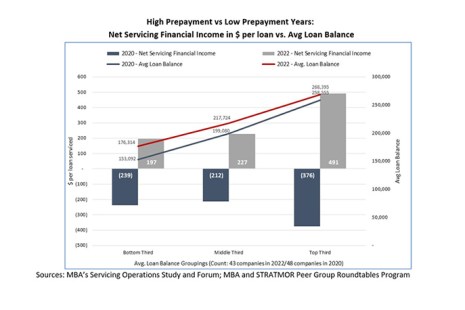

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

Black Knight: Nearly a Quarter of Homebuyers Face $3,000 Payments or More

Monthly mortgage payments between $2,000 and $3,000 have rapidly become the norm in today’s housing market in the face of spiking interest rates and historically high home prices, reported Black Knight, Jacksonville, Fla.

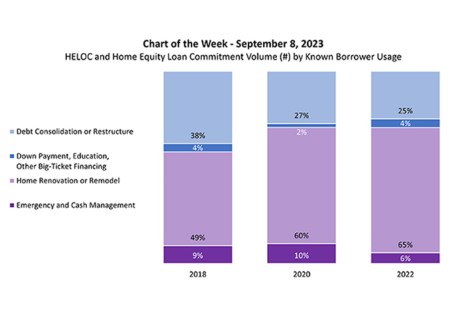

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

Dollar volume of open-end home equity lines of credit (HELOCs) and closed-end home equity loans originated in 2022 increased 50 percent compared to 2020, driven by home renovation or remodeling, according to MBA’s latest Home Equity Lending Study. This week’s Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan, according to participants in our study.

MISMO Publishes Servicing Transfer Catalog

MISMO®, the real estate finance industry’s standards organization, announced the MISMO Servicing Transfer Catalog has reached “Candidate Recommendation” status, which means it has been thoroughly reviewed by a wide range of organizations and industry participants and is available for use across the industry.

Quote Tuesday, Sept. 19, 2023

“In recent years, housing inventory constraints and home-price appreciation have resulted in rising average loan balances for single-family homeownership. Yet, financing lower balance loans is an essential way for the mortgage industry to facilitate access to affordable, lower-valued homes.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.

Cenlar’s Josh Reicher: Intelligent Automation Is Transforming Mortgage Servicing

The emergence of intelligent automation, which is the use of automation technologies–artificial intelligence, business process management and robotic process automation–is transforming how mortgage servicers do business.

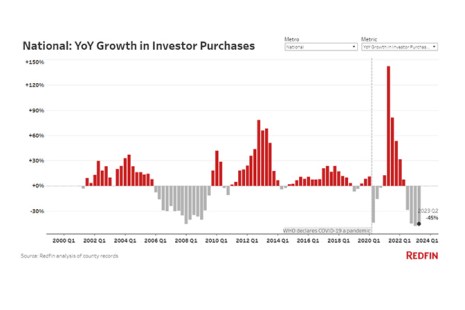

Real Estate Investors Buying 45% Fewer Homes Than Last Year, Redfin Finds

Redfin, Seattle, reported that the drop in home purchases by investors outpaced the second-quarter drop in overall home sales. Investor home purchases fell 45% from last year, compared with an overall market drop of 31%.

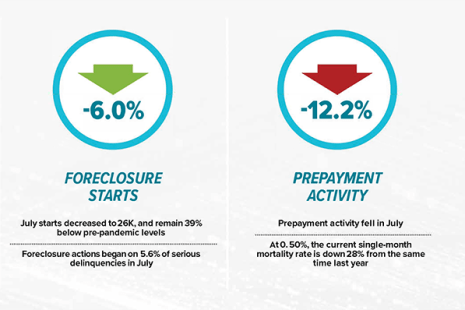

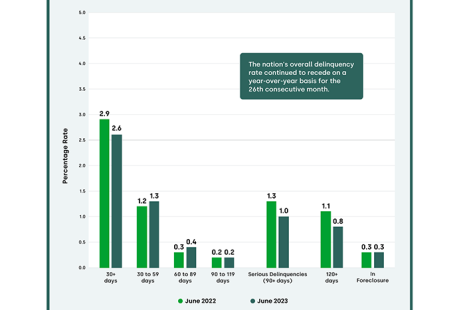

CoreLogic: No U.S. State Posts Annual Mortgage Delinquency Increases in June

U.S. mortgage performance remained exceptionally strong in June, with both overall delinquency and foreclosure rates at or near historic lows, reported CoreLogic, Irvine, Calif.

Fitch: Serious RMBS Delinquencies Trending Positively; Early Delinquencies Remain Flat

Fitch Ratings, New York, said servicers continue to work with struggling homeowners to avoid loan default, as early delinquencies remain flat and late stage delinquencies show positive movement.