Beware the Ides of April—unless it’s news you seek. Because we have plenty of housing market reports below to slake your thirst.

Tag: TransUnion

Positive Signs Even as Many Household Incomes Still Negatively Impacted by COVID-19

U.S. consumers continue to be negatively impacted one year since the onset of COVID-19, although TransUnion, Chicago, reported positive signs in its latest Consumer Pulse study.

Housing Market Roundup

Here’s a quick-hit summary of several housing and housing finance reports released over the past several days:

TransUnion: Percentage of Consumers with Financial Accommodations Remains Elevated

TransUnion, Chicago, said its latest Financial Services Monthly Industry Snapshot Report shows 2.87% of accounts in the auto, credit card, mortgage or unsecured personal loan industries remained in some form of financial hardship status at the end of December.

Housing Market Roundup

So much news, so little time and space. The end of the year seems to bring out the volume in housing market reports, so here are a couple paragraphs each on some of the latest reports to come across our desks:

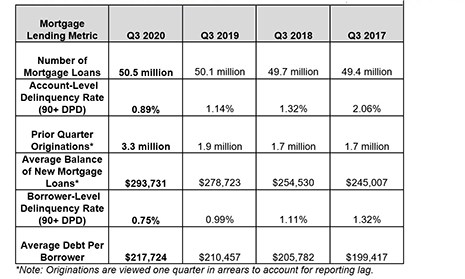

TransUnion: Popularity of 15-, 20-Year Mortgages Continues to Grow

TransUnion, Chicago, said as low interest rates drive refinance activity, short-term loans—i.e., 15-year and 20-year mortgages—continue to increase in popularity, a trend that played out in the third quarter.

Industry Briefs Nov. 5, 2020

Top of Mind Networks, Atlanta, a provider in customer relationship management and marketing automation software for the mortgage lending industry, announced its integration with digital mortgage point-of-sale platform Floify, Boulder, Colo.

Industry Briefs Oct. 23, 2020

Black Knight Inc., Jacksonville, Fla., launched a Customer Service platform that provides an enhanced customer service experience for both customer service representatives and consumers.

Consumers Resilient Despite Broader Economic Challenges

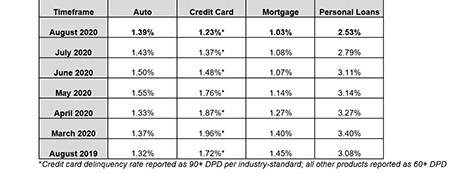

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.