Total Expert updated its products on Salesforce AppExchange, providing customers new ways to enhance the ROI of their Salesforce integrations.

Tag: TransUnion

Fed Adds 25 Basis Points to Federal Funds Rate

The Federal Open Market on Wednesday raised the federal funds rate by another 25 basis points, a move widely anticipated by analysts and financial markets.

Industry Briefs Feb. 27, 2023: CoreLogic Acquires Roostify

CoreLogic, Irvine, Calif., a global property information, analytics and data-enabled services provider, acquired Roostify, San Francisco, a digital mortgage technology provider.

Inflation Spurs Consumers to Credit Cards, Home Equity

TransUnion, Chicago, said amid rising interest rates and high inflation, the fourth quarter saw consumers continuing to look to credit as a means to help stave off financial pressures.

Industry Briefs Jan. 31, 2023: Revolution Mortgage Partners with Silverwork Solutions

Silverwork Solutions, Chicago, a developer of digital workforce BOTs, announced a partnership with Revolution Mortgage, Columbus, Ohio.

CFPB: Annual Report on Credit Reporting Companies Cites ‘Ongoing Challenges’

The Consumer Financial Protection Bureau on Tuesday issued its annual report on the industry’s three largest credit reporting companies, based on nearly a half-million complaints it received about TransUnion, Equifax and Experian.

Ramp it Up: Fed Hikes Rates by 75bps for 3rd Straight Meeting

The Federal Open Market Committee raised the federal funds rate by another 75 basis points Wednesday to 3-3.25 percent, the third consecutive such increase and the fifth increase since March.

Industry Briefs Aug. 10, 2022: TransUnion Says Serious Delinquencies ‘Normalizing’ to Pre-Pandemic Levels

TransUnion, Chicago, said the first half of 2022 concluded with a normalization in serious delinquency rates to pre-pandemic levels for most credit products as lenders continued to expand access to credit cards and personal loans.

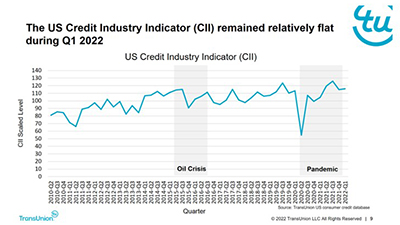

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

Rising Inflation Impacting Non-Prime Borrowers Most

As rapidly rising gasoline, energy and utility prices drive inflation, non-prime borrowers with the riskiest credit profiles have generally experienced the greatest impact to their wallets, reported TransUnion, Chicago.