TransUnion: More than 45 Million Americans Credit Unserved or Underserved

MBA NewsLink Staff

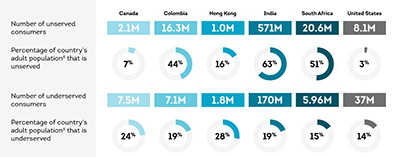

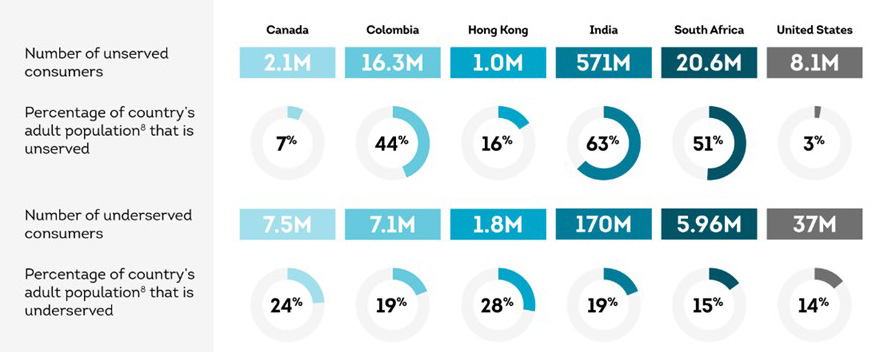

More than 45 million consumers are considered to be either credit unserved or underserved in the United States, according to a new global TransUnion study – “Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers.”

However, the study also found nearly one in four consumers (24%) who started as credit underserved were found to have migrated to becoming credit active in a two-year window prior to the pandemic. During the height of the pandemic, this percentage of consumers becoming more active decreased slightly to 22%, with the profile of those consumers skewing younger than the pre-pandemic sample.

In addition to the United States, the TransUnion global study observed consumer credit behavior in Canada, Colombia, Hong Kong, India and South Africa, to get a better sense of the market size of these unserved and underserved consumer segments.

“Hundreds of millions of consumers around the globe [are] credit unserved or underserved,” said Charlie Wise, senior vice president and global head of research and consulting with TransUnion. “These credit disadvantaged consumers are often unable to access financial products and services because they have no, or little, credit history.”

Unserved consumers are defined as any person who has never had an open traditional credit product (such as a credit card, personal loan, or auto loan, to name a few) as reported on the TransUnion consumer credit database. The underserved population has minimal credit participation, limited to a single type of credit product and no more than two open accounts of that type and have been active in the credit market for at least two years.

Two cohorts of consumers were studied, each over a two-year period – the first during the pre-pandemic period beginning March 2018 through March 2020, and the second beginning in June 2019 and studied through the pandemic time period of June 2021, to determine if there were any pandemic-related shifts with consumer credit migration trends.

The study found while some unserved (also called credit inactive) consumers may have traditional credit scores when they open their first credit product, many do not. This lack of a credit score and any history of credit activity is an impediment for these unserved consumers to get their first credit product, as many lenders are hesitant to extend credit to consumers without any credit history or score. For these traditionally unscorable consumers, they face a “chicken or egg” conundrum of how to get that first credit product when they lack a credit history.

“This reality underscores the importance of incorporating alternative data into the financial ecosystem so that fewer consumers find themselves as credit invisible,” Wise said. “Once these consumers can be evaluated by financial institutions, lenders can better determine where there might be new opportunities for growth and how they can expand credit inclusion.”

The study found every year, a portion of the underserved consumer population – those with minimal credit activity – become more fully credit active by opening additional credit products, while many still remain in that underserved segment. The most common first credit products held by underserved consumers in the United States were credit cards (44%), which was seen to an even greater degree in the Canadian market (84%). This mirrors broader trends that TransUnion has observed in these developed countries, where credit cards are the most common first product for consumers entering the credit market. This varied by country, however.

The study also found consumers who migrated from underserved to served (opened at least one new product type) over the two-year period had more inquiries – applications for new credit – than consumers who remained underserved. While some of that higher inquiry activity was attributable to the fact that they opened new accounts, the overall higher level of inquiry activity by those consumers who migrated to the served segment implies that these consumers have a significantly higher demand for new credit, and that this demand is not necessarily being met by lenders.

“The number of new credit inquiries were materially higher for consumers that migrated to served compared to consumers who remained underserved,” Wise said. “These consumers appear to want more credit, but they are not necessarily able to access the credit they want, potentially due to their limited credit history. This highlights a missed opportunity for lenders who are seeking to grow and add new customers. Many of these underserved consumers would likely be well-performing and profitable borrowers, but because of their limited credit history, lenders are reluctant to extend them credit. Incorporating alternative data on consumers into lending decisions could enable lenders to get a fuller picture of the financial capacity of underserved consumers and make credit available to more of them.”