A new survey from TransUnion, Chicago, found that many consumers feel their mortgage payments are putting a strain on their household finances, and the prospect of falling interest rates has them ready to consider refinancing those loans.

Tag: TransUnion

TransUnion: First-Quarter Mortgage Origination Volumes Up Slightly

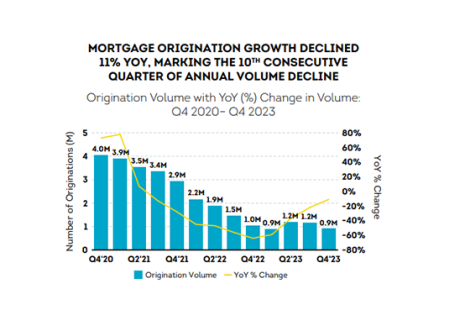

First-quarter mortgage origination volumes increased by 2% year-over-year to 915,000, according to TransUnion, Chicago.

TransUnion: Consumer Outlook Mixed in Q2

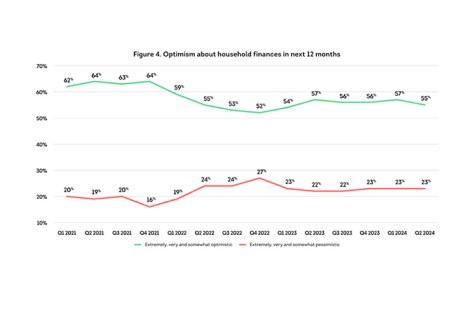

TransUnion, Chicago, released its Consumer Pulse Study for the second quarter, finding consumer concerns about inflation and interest rates have hit their highest levels in two years. However, more than half of Americans remain optimistic about their household finances over the next year.

TransUnion Finds Consumer Credit Appetite Remains High

The consumer credit market remains resilient in the face of a challenging economic environment, according to TransUnion, Chicago.

FOMC Holds Rates Steady

The Federal Open Market Committee held interest rates steady yesterday–as many forecasters had predicted.

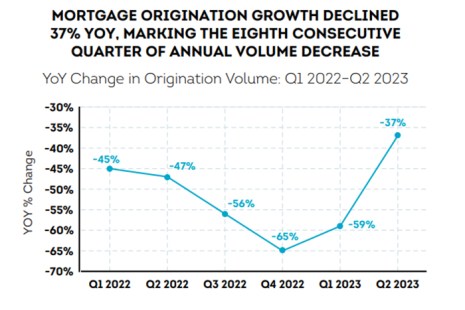

TransUnion: Mortgage Originations Down Almost 37% in Third Quarter Amid Higher Credit Balances

TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.

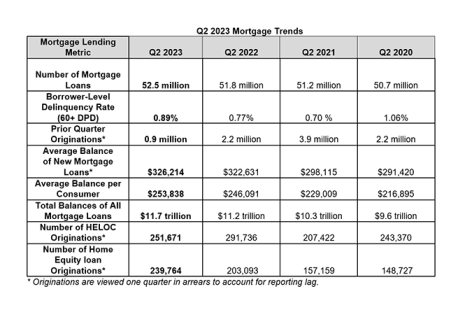

TransUnion: Mortgage Balances Remain Near Record Highs; More Consumers Turn to Home Equity Loans

TransUnion, Chicago, said total mortgage balances fell to $11.7 trillion in the second quarter, down slightly from last quarter’s record high but up 4.3% year-over-year.

Fed Keeps Rates Steady But Options Open

The Federal Open Market Committee held rates steady at its June meeting but kept its options open for July and later this year.

TransUnion: Credit Card, Unsecured Personal Loan Balances at or Near Record Levels

TransUnion, Chicago, said consumers are increasingly turning to credit to manage their household budgets in the current economic environment, leading to record- or near-record high balances in credit cards and unsecured loans.

Industry Briefs Apr. 7, 2023: HUD Extends AFFH Proposed Rules Comment Period by 2 Weeks

HUD extended the public comment date for its Affirmatively Furthering Fair Housing proposed rule by 14 days, to April 24, per a notice in the Federal Register.