Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

Tag: Technology

Josh Friend: Engagement is Critical During Challenging Times

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

Josh Friend: Engagement is Critical During Challenging Times

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

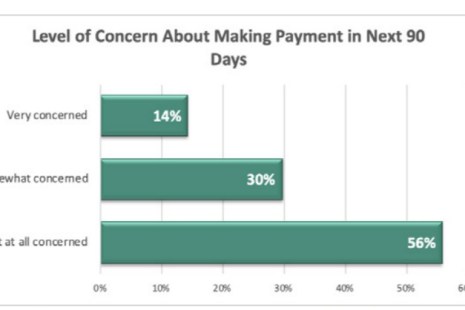

STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard hitting the coronavirus pandemic has been on homeowners.

Mark Dangelo: Innovation Thinking—Winning in an Uncertain Future

The financial services and mortgage industries have not felt the full impact and unintended consequences of COVID-19 and the governmental interventions. The result will be that innovation disruption moving forward will be not be kind, will not be benevolent, and will not be industry friendly.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.