MBA Newslink recently interviewed Dawar Alimi, CEO and Co-Founder of Lender Price, to discuss the significance of lenders having product depth to drive additional volume, how automation is driving cost reduction and overall efficiencies and the evolving role of technology in shaping mortgage lending.

Tag: Servicing

FHFA Says Nearly 44,000 Troubled Homeowners Assisted During 4Q2023

Fannie Mae and Freddie Mac completed 43,903 foreclosure prevention actions during the fourth quarter, raising the number of homeowners who have been helped to 6.9 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

Blue Sage Solutions’ Carmine Cacciavillani–How a Bridge in the Cloud Creates Endless Opportunities

One of the most interesting paradoxes is the Mobius strip, a two-dimensional shape made by taking a strip of paper, twisting one end 180 degrees, and taping the ends together, forming one continuous surface.

Carmine Cacciavillani from Blue Sage Solutions: How a Bridge in the Cloud Creates Endless Opportunities

One of the most interesting paradoxes is the Mobius strip, a two-dimensional shape made by taking a strip of paper, twisting one end 180 degrees, and taping the ends together, forming one continuous surface.

FHA Commissioner Gordon Announces New Loss Mitigation Option: #MBAServicing24

ORLANDO–Loss mitigation made news last week at MBA’s Servicing Solutions Conference & Expo 2024.

Executives Discuss Their Challenges, Goals: #MBAServicing24

ORLANDO–Top executives from PennyMac Financial Services, Merchants Bank of Indiana, M&T Bank Corp., Mr. Cooper and Freedom Mortgage Corp. discussed the biggest challenges the mortgage servicing industry faces here at MBA’s Servicing Solutions Conference & Expo 2024.

Laura Escobar on Unsung Heroes– #MBAServicing24

ORLANDO–Mortgage servicers are the backbone of the industry, according to Laura Escobar, 2024 MBA Chair-Elect and President, Lennar Mortgage.

LERETA Survey Reveals Lack of Understanding of Escrow Accounts

LERETA, Pomona, Calif., released a new survey showing that among respondents who have an escrow account with their mortgage, only 52% “completely” understand how that account works.

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.22% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 0.23% of servicers’ portfolio volume in the prior month to 0.22% as of Jan. 31, 2024.

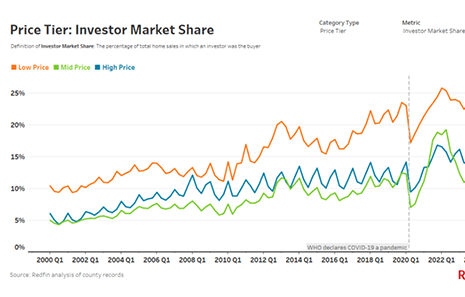

Redfin: Investors Bought Bigger Share of Affordable Homes in Late 2023

Real estate investors bought just over 26% of the low-priced homes that sold in the fourth quarter–the highest share on record, according to Redfin, Seattle.