ATTOM: California, New Jersey, Illinois Have Highest Concentrations of At-Risk Markets

(Illustration courtesy of ATTOM)

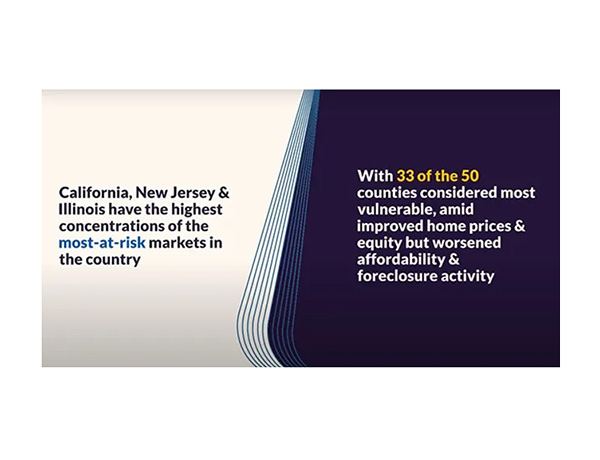

California, New Jersey and Illinois have the highest concentrations of the most-at-risk markets in the country, according to ATTOM, Irvine, Calif.

The company’s new Special Housing Risk Report spotlights county-level housing markets around the country that are more or less vulnerable to declines based on home affordability, foreclosures, underwater mortgages and other measures in the third quarter. The report found the biggest clusters in the New York City and Chicago areas as well as central California. Less-vulnerable markets are spread mainly throughout the South, Midwest and Northeast.

“Some parts of the country continue to pop up on the radar as places to watch for signs of housing-market drop-offs, based on key quarterly measures,” ATTOM CEO Rob Barber said.

But Barber noted the most vulnerable list does not signal an imminent crash for any local market. “It just means that they have greater potential tripwires that could lead to a decline,” he said. “Those remain areas to watch, especially given the overall varied trends in the market.”

The third-quarter patterns revealed that California, New Jersey and Illinois had 33 of the 50 counties considered most vulnerable to potential drop-offs. Those concentrations overshadowed other parts of the country at a time of mixed market trends when home prices and homeowner equity improved but home affordability and foreclosure activity worsened.

Nationwide, one in 1,389 homes received a foreclosure filing in the third quarter, ATTOM reported. Foreclosure actions have risen since the July 2021 expiration of a federal moratorium on lenders taking back properties from homeowners who fell behind on their mortgages during the early part of the Coronavirus pandemic that hit in 2020. While foreclosure rates remain low, nearly four times as many cases were open in the third quarter of this year compared to the point when the moratorium was lifted.

The highest foreclosure rates among the top 50 counties were in Cumberland County (Vineland), N.J., (one in 359 residential properties facing possible foreclosure); Warren County, N.J. (outside Allentown, Pa.) (one in 459); Sussex County, N.J. (outside New York City) (one in 461); Gloucester County, N.J. (outside Philadelphia) (one in 470) and Camden County, N.J. (one in 509).