Preventing foreclosures requires active collaboration between servicers and homeowners.

Tag: Servicing

Clarifire’s Jane Mason–Forgoing Automation is Literally Setting Servicers Up for Disaster

Without process automation, servicers have no hope of delivering the responsiveness, rapid relief options, proactive outreach, and education borrowers need when they need it most.

Forgoing Automation is Literally Setting Servicers Up for Disaster–Clarifire’s Jane Mason

Without process automation, servicers have no hope of delivering the responsiveness, rapid relief options, proactive outreach, and education borrowers need when they need it most.

Forgoing Automation is Literally Setting Servicers Up for Disaster–Clarifire CEO Jane Mason

Without process automation, servicers have no hope of delivering the responsiveness, rapid relief options, proactive outreach, and education borrowers need when they need it most.

Foreclosure Activity Drops, ATTOM Finds

ATTOM, Irvine, Calif., said U.S. properties with foreclosure filings are falling, down 2% from the previous quarter and down 13% from a year ago.

Hurricane Season Is Here. Servicers Should be Prepared–Anthony Scotese from ServiceLink

The destruction and devastation from Hurricane Helene continue to be felt across the southeastern United States, where more than 200 people died from the storm as of Oct. 5.

Hurricane Season Is Here. Servicers Should be Prepared–ServiceLink’s Anthony Scotese

The destruction and devastation from Hurricane Helene continue to be felt across the southeastern United States, where more than 200 people died from the storm as of Oct. 5.

ServiceLink’s Anthony Scotese: Hurricane Season Is Here. Servicers Should be Prepared

The destruction and devastation from Hurricane Helene continue to be felt across the southeastern United States, where more than 200 people died from the storm as of Oct. 5.

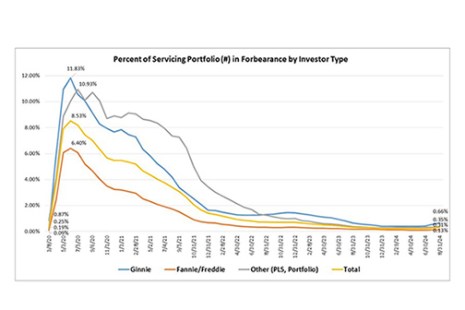

MBA: Share of Mortgage Loans in Forbearance Increases to 0.31% in August

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.31% as of August 31, 2024.

Sept. 18: How AI Can Help Servicers Combat the High Cost of Borrower Communications

This is a sponsored webinar. Please be advised your contact information will be shared with the sponsor. In today’s challenging economic environment, mortgage servicers face significant pressure to control costs. …