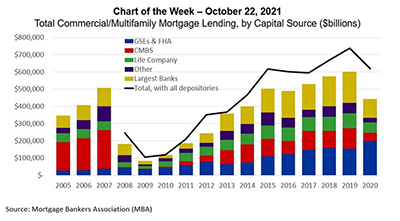

Sometimes research is like putting a puzzle together – trying to fit one piece of information with another to create a full picture of what’s happening. This week, we are adding a new, final piece to the puzzle of how much commercial real estate lending happens each year.

Tag: Reggie Booker

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

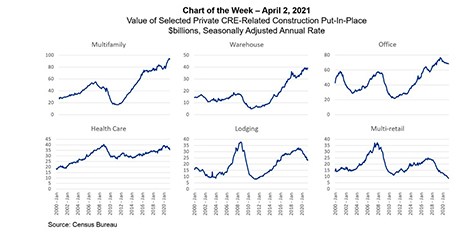

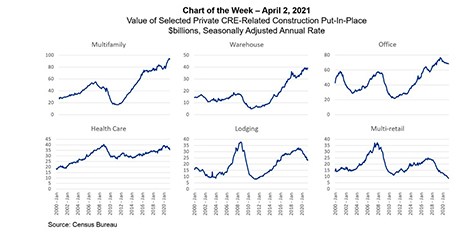

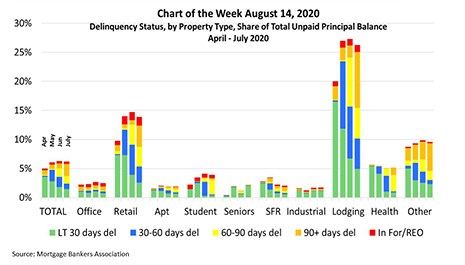

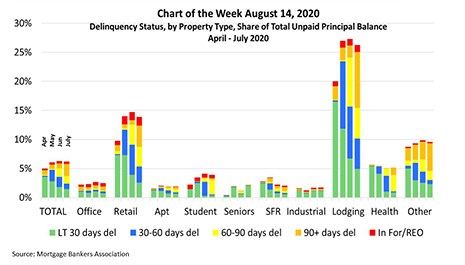

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

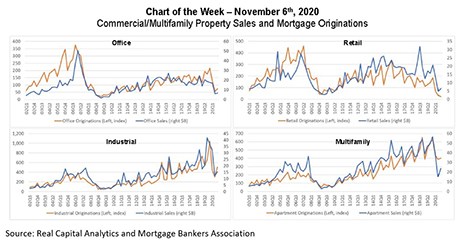

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

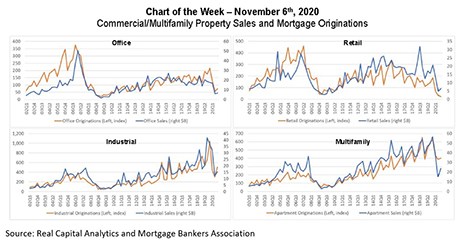

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

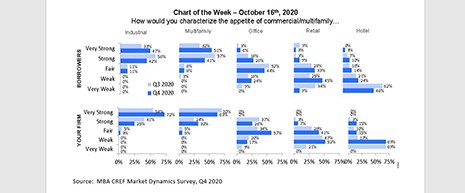

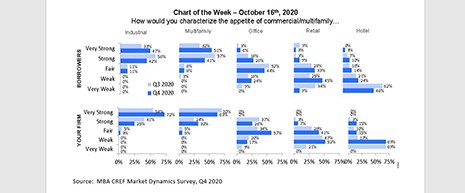

MBA Chart of the Week: Appetite for Commercial/Multifamily

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.

MBA Chart of the Week: Appetite for Commercial/Multifamily

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.

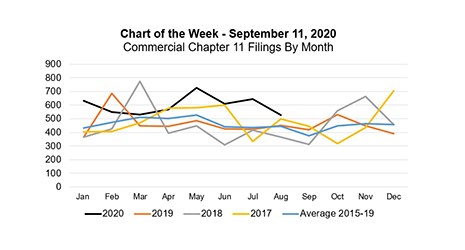

MBA Chart of the Week: Commercial Chapter 11 Filings By Month

As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.