Commercial mortgage delinquencies increased in the first quarter, according to the Mortgage Bankers Association’s latest Commercial Mortgage Delinquency Rates Report.

Tag: Reggie Booker

MBA: Commercial/Multifamily Borrowing Increases 42% in the First Quarter of 2025

Commercial and multifamily mortgage loan originations were 42% higher in the first quarter of 2025 compared to a year earlier, and decreased 40% from the fourth quarter of 2024, according to MBA’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

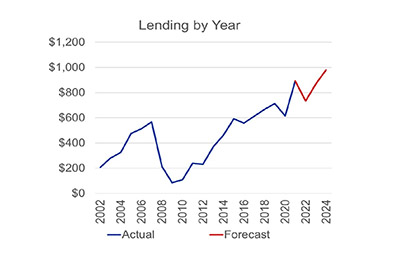

Chart of the Week: Total Commercial Real Estate Lending

According to MBA’s Annual Origination Summation, from 2020 to 2024, commercial and multifamily mortgage originations experienced notable shifts across investor types.

Total Commercial Real Estate Borrowing and Lending Increased 16% in 2024, MBA Reports

Total commercial real estate mortgage borrowing and lending is estimated to have totaled $498 billion in 2024, a 16% increase from the $429 billion in 2023, and a 39% decrease from $816 billion in 2022.

Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

According to MBA’s Quarterly Mortgage Debt Outstanding Report, total commercial and multifamily mortgage debt outstanding increased by 3.7% year-over-year, rising from $4.62 trillion in Q4 2023 to $4.79 trillion in Q4 2024. This growth reflects continued investment in commercial real estate, with sector-specific variations in debt allocation.

MBA Forecast: 2023 Commercial/Multifamily Lending to Fall 20%

CHICAGO–Total commercial and multifamily mortgage borrowing and lending is expected to fall to $654 billion this year, a 20 percent decline from $816 billion in 2022, according to an updated baseline forecast released here by the Mortgage Bankers Association

MBA Forecast: 2023 Commercial/Multifamily Lending to Fall 20%

CHICAGO–Total commercial and multifamily mortgage borrowing and lending is expected to fall to $654 billion this year, a 20 percent decline from $816 billion in 2022, according to an updated baseline forecast released here by the Mortgage Bankers Association at its 2023 Commercial/Multifamily Finance Servicing & Technology Conference.

MBA Releases 2022 Rankings of Commercial/Multifamily Mortgage Firms’ Origination Volumes

The following firms were the top commercial/multifamily mortgage originators in 2022, according to a set of commercial/multifamily real estate finance league tables prepared by the Mortgage Bankers Association:

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

MBA Launches Commercial Real Estate Finance Student Fellowship Program

The Mortgage Bankers Association launched a new fellowship program for students from underrepresented groups interested in learning more about internships, jobs and careers in the $4 trillion commercial real estate finance industry.