A slight drop in interest rates in January stabilized refinance activity and improved closing rates, said Ellie Mae, Pleasanton, Calif.

Tag: Refinances

Gen Z Displays Strong Appetite for Credit; Millennials Refinance Less (For Now)

TransUnion, Chicago, said Generation Z consumers—those born in or after 1995—are actively seeking credit despite many of them growing up during severe economic recessions in their respective global markets.

Applications Increase in MBA Weekly Survey

Mortgage applications increased 3.8 percent from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 6, 2019.

Black Knight: Servicer Retention Rates Fall in Q3 Despite 3-Year High in Refinance Volumes

Black Knight, Jacksonville, Fla., said After hitting an 18-year low in Q4 2018, refinance lending has nearly doubled (+94%) over the past three quarters.

Millennial Refinance Activity Hits 2019 Peak; Home Prices Growth Fastest in 6 Years

Ellie Mae, Pleasanton, Calif., said the share of refinances closed by millennials in October increased to a new high as interest rates on 30-year loans fell.

Ellie Mae: October Refis Show Strength

Ellie Mae, Pleasanton, Calif., said refinances accounted for the highest percentage of closed loans in October since March 2015.

Ellie Mae: Millennial Home Refinance Boom at 3-Year High

Ellie Mae, Pleasanton, Calif., said Millennials closed 33% of all mortgage refinances in September, the largest such share since it began tracking data in January 2016.

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications decreased slightly from one week earlier as key interest rates fell back below 4 percent, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 1.

MBA 2020 Forecast: Purchase Originations to Increase 1.6 Percent to $1.29 Trillion; Refinance Activity Expected to Slow after Strong 2019

AUSTIN, TEXAS–The Mortgage Bankers Association expects purchase originations to increase by 1.6 percent to $1.29 trillion in 2020.

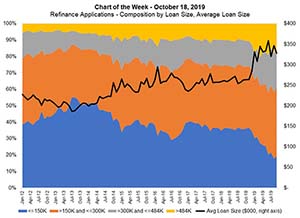

MBA Chart of the Week: Refinance Applications by Loan Size

We saw a downward turn in mortgage rates in late 2018, which started when there was a flight to quality in response to concerns about a slowdown in the global economy and trade tensions between the U.S. and China. The drop in mortgage rates led to a revival in the refinance market in 2019.