Fannie Mae and Freddie Mac issued temporary guidance regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

Tag: Refinances

FHFA Announces Refi/Home Purchase Eligibility for GSE Borrowers in Forbearance

Fannie Mae and Freddie Mac issued temporary guidance regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

Ellie Mae: Low Rates Spur Refinance Activity to Historic High

Ellie Mae, Pleasanton, Calif., said refinance activity reached a record high in March for millennial borrowers as interest rates plummeted.

Ellie Mae: Refis Grow as Interest Rates Continue to Drop

Ellie Mae, Pleasanton, Calif., said as interest rates continued to decline in March to the lowest percentage since January 2013, it drove up the percentage of refinances.

Ellie Mae: Older Millennials Drive February Refinance Surge

Older Millennials—and yes, there is such a thing—took advantage of near record-low interest to spark a surge in refinancings, according to the Millennial Tracker report from Ellie Mae, Pleasanton, Calif.

ATTOM: 4Q Refinances More than Double

ATTOM Data Solutions, Irvine, Calif., reported 1.27 million refinance mortgages secured by residential property originated in the fourth quarter, up 20 percent from the third quarter and up by 104 percent from a year ago to the highest point since third quarter 2013.

Ellie Mae: Refis, Closing Rates Up

Mortgage interest rates are low—you know that; refinancings have been going through the roof—and if you’ve been following the Mortgage Bankers Association’s Weekly Applications Survey or the activity in your office, you know that, too. But Ellie Mae, Pleasanton, Calif., has another stat you might be interested in: closing times, which have also dramatically improved.

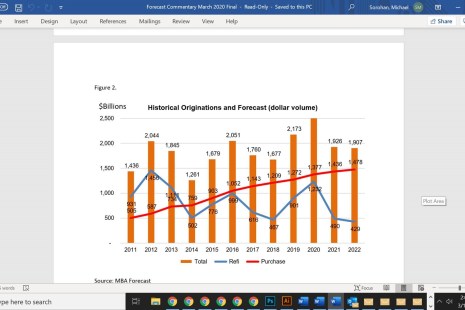

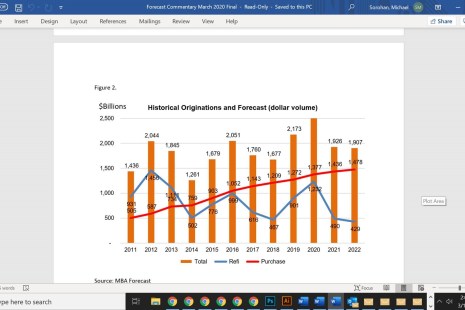

MBA Doubles 2020 Refinance Forecast

The Mortgage Bankers Association this week issued its revised Mortgage Finance Forecast and Economic Forecast, in which MBA doubled its previous 2020 refinance mortgage originations projections.

MBA Doubles 2020 Refinance Forecast

The Mortgage Bankers Association today issued its revised Mortgage Finance Forecast and Economic Forecast, in which MBA doubled its previous 2020 refinance mortgage originations projections.

Mortgage Fraud Risk Falls to New Low

First American Financial Corp., Santa Ana, Calif., said frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications decreased by 3.0 percent from December to the lowest level since the company began tracking such data in 2011.