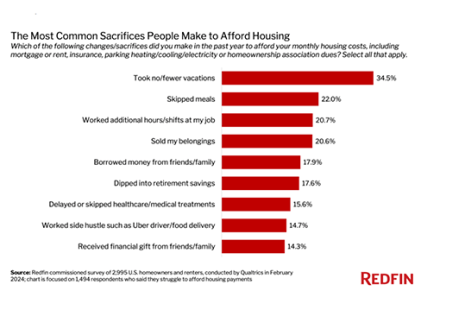

Half of U.S. homeowners and renters sometimes, regularly or greatly struggle to afford their housing payments, according to a new report from Redfin, Seattle.

Tag: Redfin

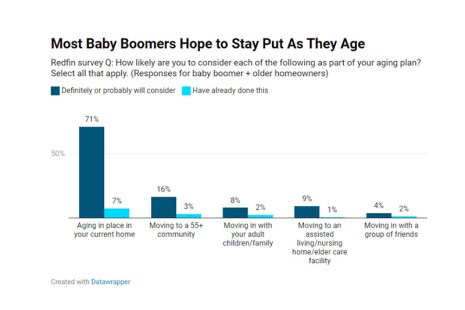

Redfin Finds 78% of Baby Boomers Plan to Stay in Current Home as They Age

Redfin, Seattle, conducted a survey to determine Baby Boomers’ plans for where to live as they age. More than three-quarters said they plan to age in their homes.

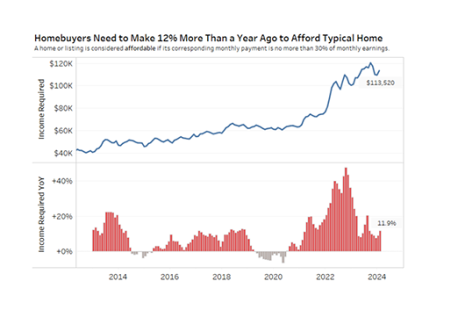

Redfin: Typical Household Earns $30,000 Less Than Needed to Afford Median-Priced Home

Buyers need to earn $114,000 to afford the typical U.S. home–35% more than the typical household makes, according to Redfin, Seattle.

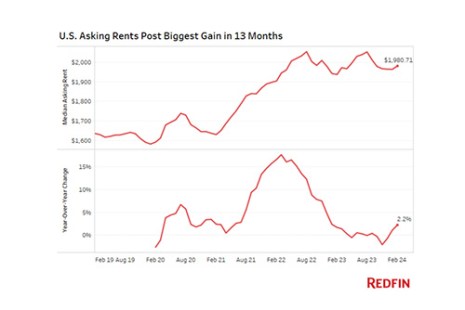

Redfin: Asking Rents Up 2% in February

Redfin, Seattle, reported asking rents rose 2.2% year-over-year to $1,981 in February. They also grew by 0.9% from January.

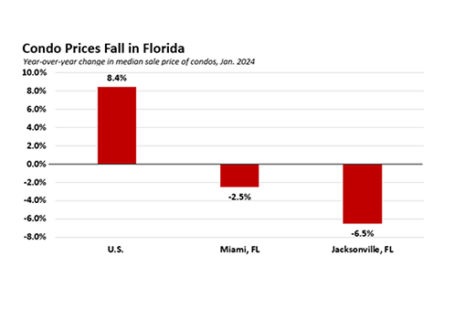

Redfin Reports Florida Condo Prices Falling as Insurance; HOA Fees Skyrocket

Prices of condos in some major Florida metros are dropping year-over-year and sales are declining as insurance costs and homeowners association fees climb, according to Redfin, Seattle.

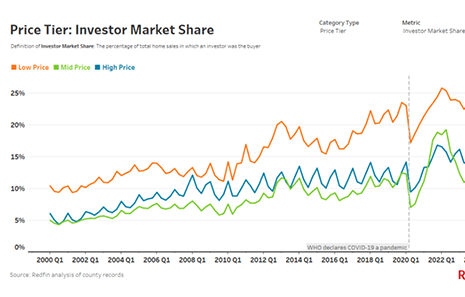

Redfin: Investors Bought Bigger Share of Affordable Homes in Late 2023

Real estate investors bought just over 26% of the low-priced homes that sold in the fourth quarter–the highest share on record, according to Redfin, Seattle.

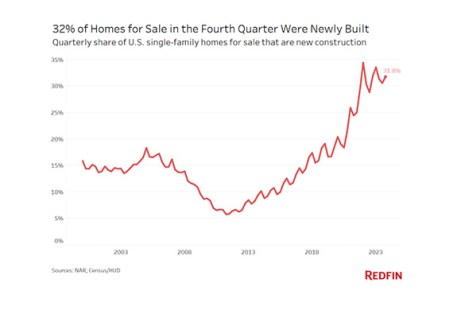

Redfin: New Builds as Share of Homes for Sale in Q4 Near Record High

Redfin, Seattle, found in a recent report that 31.8% of U.S. single-family homes for sale in the fourth quarter were new construction, just shy of the all-time fourth quarter high of 31.9%.

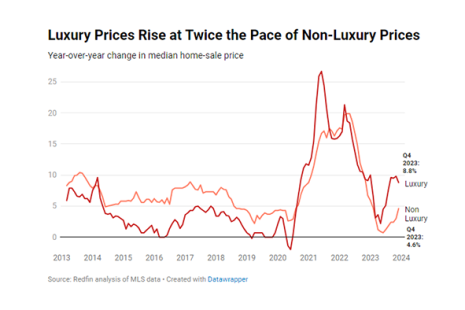

Luxury Home Prices Hit New High; Record Share of High-End Buyers Pay Cash: Redfin

The typical U.S. luxury home sold for a record $1.17 million in the fourth quarter, up 8.8% from a year earlier, according to Redfin, Seattle.

Pending Home Sales See Biggest Jump in Over Two Years

Homebuyers came out of the woodwork in December as mortgage rates posted the biggest monthly decline since 2008.

Redfin: Median Asking Rent Continues to Decline

Redfin, Seattle, reported the median U.S. asking rent fell 0.8% year-over-year in December, marking the third consecutive decline.