Real Estate Investors Buying 45% Fewer Homes Than Last Year, Redfin Finds

(Image courtesy Redfin)

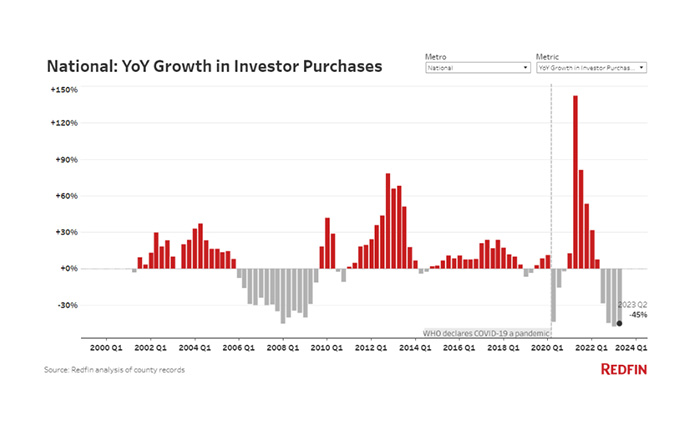

Redfin, Seattle, reported that the drop in home purchases by investors outpaced the second-quarter drop in overall home sales. Investor home purchases fell 45% from last year, compared with an overall market drop of 31%.

That’s the largest decline for investor purchases since 2008, other than the 48% drop in Q1 2023.

The number of homes bought by investors is now below pre-pandemic levels, with just 50,000 purchased in Q2.

Investors bought 15.6% of homes that were sold in the U.S. during Q2, down from 19.7% in Q2 2022 and the record high of 20.4% at the beginning of 2022.

“Offers from hedge funds have dried up; I haven’t received an offer from one in a long time, except unrealistically low offers,” said Las Vegas Redfin Premier agent Shay Stein. “From mid-2020 until early 2022 when interest rates started going up, hedge funds bought up a ton of properties and immediately turned them into rentals, pricing out local buyers. Now a big portion of our homes are owned by investors, but they’re not adding to their portfolios.”

In terms of the houses investors are still buying, they tend to go for low-priced homes. Investors purchased 23% of low-priced homes in the second quarter, much higher than their market share for high-priced homes (14%).

Additionally, single-family homes made up 68% of investor purchases in the second quarter, down from 73% a year earlier. Redfin attributes that to a lack of single-family homes for sale.

Homes sold by investors are also making up a smaller share of the market, with investors owning just 8% of new listings in March, down from 9% a year earlier. That’s also down from a peak of 13% at the end of 2021.

However, investors who are flipping homes are making money–the typical home flipper who sold a house in June sold it for 61% more than their initial purchase price.