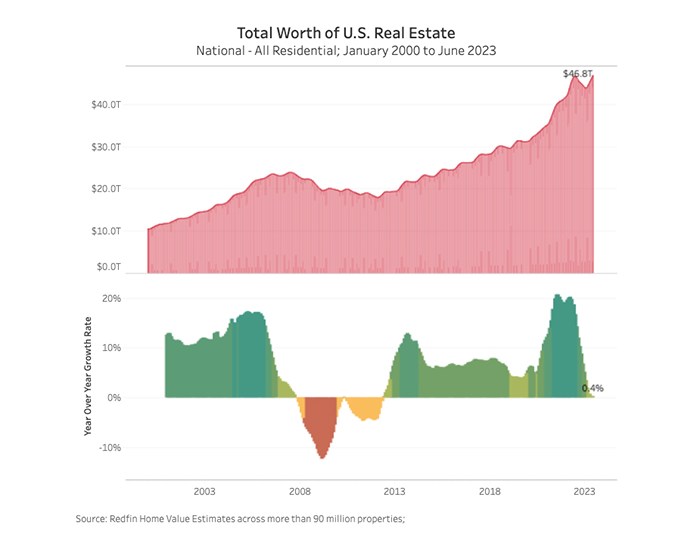

Redfin: U.S. Housing Market Hits Record at Nearly $47 Trillion in Total Value

(Image courtesy Redfin)

Redfin, Seattle, reported the estimated total worth of U.S. homes hit a record $46.8 trillion in June, beating a record of $46.6 trillion set last year.

The market has now offset the almost $3 trillion lost due to rising mortgage rates from June 2022-February 2023.

The record is being propelled by prices pushed up by the housing shortage.

“The dominance of the 30-year fixed rate mortgage in America is propping up home values,” said Redfin Economics Research Lead Chen Zhao. “Tons of homeowners scored an incredible deal during the pandemic: a 3% mortgage rate for the remainder of their 30-year loan. Now they’re staying put because moving would mean taking on a rate that’s twice as high. This means buyers who are in the market now are duking it out for a very small pool of homes, preventing home values from plunging.”

In 32 metro areas, aggregate home values did decline from a year earlier. Eleven were in California and seven were in Texas, with a 9.6% drop in Austin the highest.

Those are some of the priciest markets in the country, and many have been harder hit by remote work and downturns in the tech sector.

In contrast, more affordable markets saw gains. The largest increase–8.8%–was in Little Rock, Ark.

Urban areas were slightly harder hit than suburban and rural communities. The total value of homes in urban areas fell 0.9% year-over-year, the suburbs rose 0.2% and rural areas increased by 2.6%.

The home value held by millennials rose 2.9% year-over-year to $5 trillion, the largest generational increase. The value of homes owned by the Silent Generation fell 11.4%, Gen X fell 0.7% and Baby Boomers’ value was flat.

This analysis estimated current (June 2023) home values using the Redfin Estimate, MLS data and public records.