The Mortgage Bankers Association Builder Application Survey data for October 2024 shows mortgage applications for new home purchases increased 8.2% compared from a year ago.

Tag: Purchase Applications

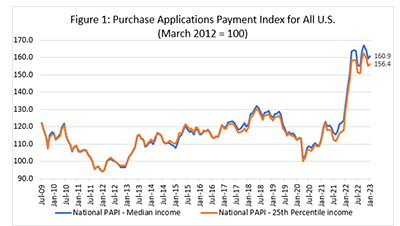

MBA Chart of the Week: Purchase Applications Index

In the wake of stronger economic data, including reports on jobs and inflation, mortgage rates have moved higher, with the 30-year fixed rate rising to 6.36%– the highest since August, based on the most recent data from the MBA’s Weekly Applications Survey.

MBA: Mortgage Application Payments Increased 2.3% in January to $1,964

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing 2.3 percent to $1,964 from $1,920 in December 2022, the Mortgage Bankers Association reported.

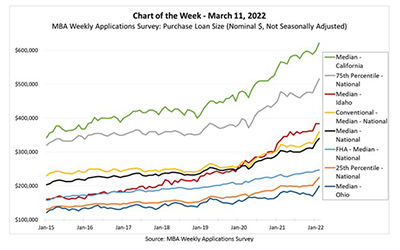

MBA Chart of the Week Mar. 11, 2022: MBA Weekly Applications Survey Purchase Loan Size

With increasing home prices, it is instructive to understand how home purchase mortgage origination amounts have increased. In this week’s MBA Chart of the Week, we examine how the loan size for fixed-rate 30-year purchase mortgage applications has changed since 2015 using MBA’s Weekly Applications Survey data.

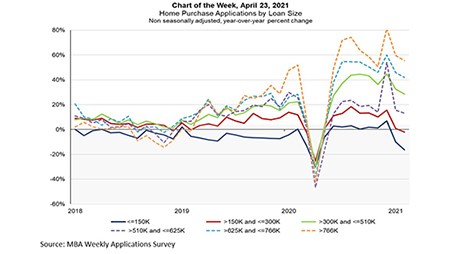

MBA Chart of the Week: Home Purchase Applications By Loan Size

This week’s MBA Chart of the Week examines year-over-year growth in purchase loan applications by loan size since 2018.

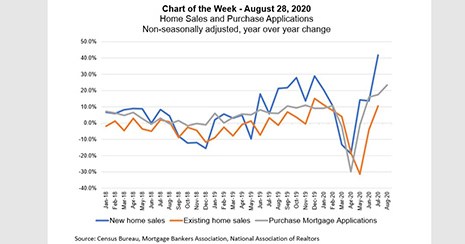

MBA Chart of the Week: Home Sales and Purchase Applications

As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.

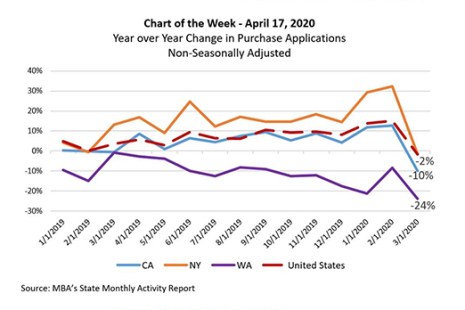

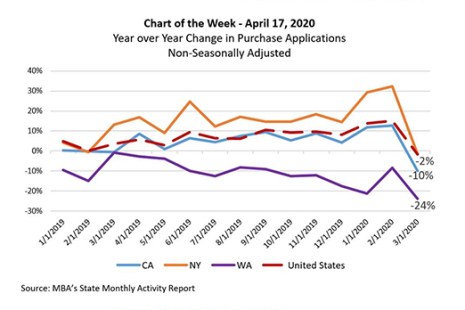

MBA Chart of the Week: Year over Year Change in Purchase Applications

According to data from MBA’s State Monthly Activity Report (SMAR), purchase applications grew for 14 consecutive months until the impacts of COVID-19 slowed activity to a 2 percent decline in March. Most of the decline was likely in the last two weeks of the month, when many states enacted restrictions on non-essential business and social activity.

MBA Chart of the Week: Year over Year Change in Purchase Applications

According to data from MBA’s State Monthly Activity Report (SMAR), purchase applications grew for 14 consecutive months until the impacts of COVID-19 slowed activity to a 2 percent decline in March. Most of the decline was likely in the last two weeks of the month, when many states enacted restrictions on non-essential business and social activity.

Mortgage Applications Up Again in MBA Weekly Survey

Mortgage applications rose for the third straight week, continuing a solid start to the new year despite a slight increase in interest rates, the Mortgage Bankers Associations morning in its Weekly Mortgage Applications Survey for the week ending February 7.

Mortgage Applications Decrease in MBA Weekly Survey

What goes up, must come down. Following a stellar start to the month last week, in which mortgage applications jumped by more than 30 percent after the New Year’s holiday, the pendulum swung back slightly.