MBA Chart of the Week: Home Purchase Applications By Loan Size

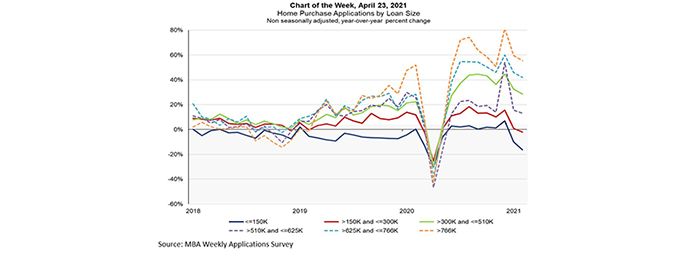

This week’s MBA Chart of the Week examines year-over-year growth in purchase loan applications by loan size since 2018.

The high and increasing growth trends in applications for larger loans (over $625,000) that became pronounced in 2019 continued in the second half of 2020 (following the V-shaped COVID dip). While the acceleration appears to have stalled in 2021, the growth rates in February remained high—at 42% and 55% for the $625,000-$766,000 and the $766,000-plus loan size buckets, respectively. Indeed, the share of these two groups, which made up 8% of purchase applications three years ago, now accounts for over 15%.

The dynamics for purchase loan applications between $300,000 and $510,000 (green line) have followed a similar trend as the larger ($625,000+) loans, although at lower growth levels. These loans accounted for about 21% of the purchase loan applications at the start of 2018, but as of this February, their share reached almost 32%. The red line, which depicts the growth for the $150,000-$300,000 bucket, also exhibits an analogous (but lower) growth pattern. This bucket remains the largest, with a 35% percent share of purchase applications in February 2021, albeit down from over 40% at the start of 2018.

The blue line shows the pattern for purchase loan applications of up to $150,000. These (small-dollar mortgage) loans are regularly considered important for families to be able to purchase affordable homes, subsequently benefitting from homeownership and its associated wealth accumulation. However, their share is shrinking, with negative growth for most of the last three years (except for the second half of 2020). As of February, this bucket accounted for 15% of purchase loan applications—down from approximately 25% three years ago.

From the chart, the smallest two loan size tiers lag in growth when compared to the high-loan size categories. Even before the pandemic, the supply of lower priced, entry-level homes was tight. This continues to persist, even as homebuilders have done their best to increase production. Buyers in these loan size tiers are likely more price sensitive and the accelerating home price gains have likely contributed to the slower growth, even when these lower-priced homes do come on the market.

–Joel Kan jkan@mba.org; Edward Seiler eseiler@mba.org.