LendingTree, Charlotte, N.C., found median property taxes in the U.S. rose by an average of 10.4% from 2021-2023. They also rose in the largest 50 U.S. metro areas during that time period.

Tag: Property Taxes

ATTOM: Average Property Taxes on Single-Family Homes Up 2.7% in 2024

ATTOM, Irvine, Calif., released its 2024 property tax analysis, finding that the average tax on a single-family home last year was $4,172 in 2024, a 2.7% increase from the previous year.

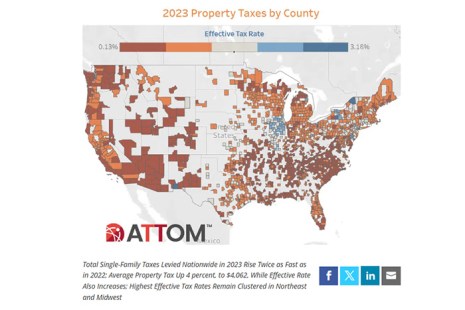

ATTOM: Overall Property Taxes Rose 7% in 2023

ATTOM, Irvine, Calif., released an analysis of property taxes across the U.S., finding that there was a 6.9% increase in overall property taxes levied in 2023 from 2022.

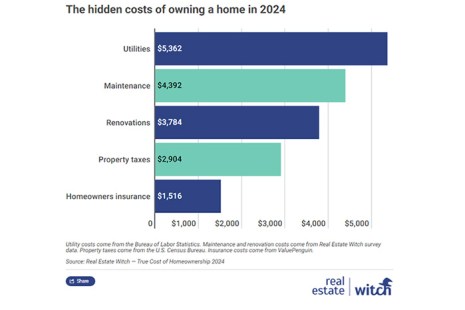

Homeowners Average Almost $18,000 Per Year on Non-Mortgage Expenses

The average homeowner spends $17,958 on non-mortgage expenses, a recent study found, listing categories such as maintenance, improvements, utilities, property taxes and insurance.

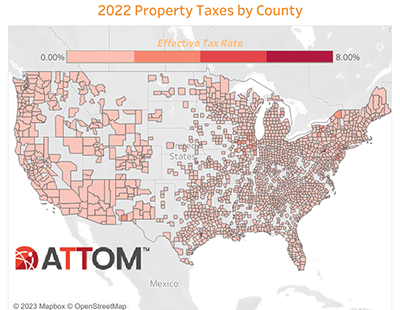

ATTOM: 2022 Single-Family Property Taxes Up 4%

Property taxes on single-family homes grew 3.6% last year, more than double 2021’s 1.6% growth rate, reported ATTOM, Irvine, Calif.

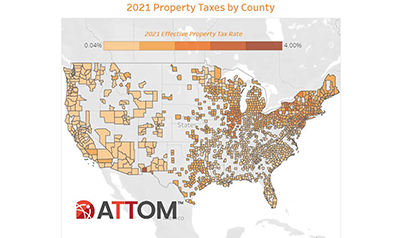

2021 Single-Family Property Taxes Rise to $328 Billion

ATTOM, Irvine, Calif., said its 2021 property tax analysis of nearly 87 million U.S. single family homes reported $328 billion in property taxes levied on single-family homes, up 1.6 percent from $323 billion in 2020, but well down from the 5.4 percent increase seen from 2019 to 2020.

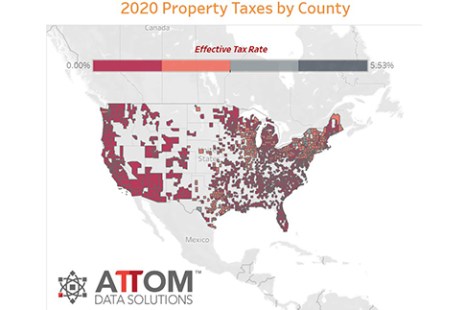

ATTOM: 2020 Single-Family Property Taxes Rise 5.4% to $323B

Single-family homeowners saw their property taxes rise on average by 5.4 percent in 2020, to a nationwide total of $323 billion, reported ATTOM Data Solutions, Irvine, Calif.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.