ATTOM: 2020 Single-Family Property Taxes Rise 5.4% to $323B

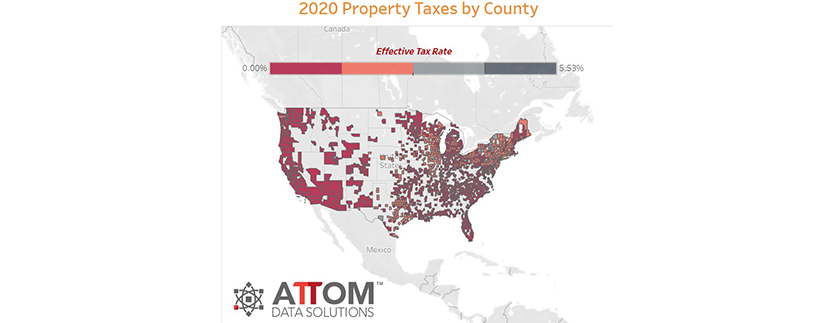

(Infographic courtesy ATTOM Data Solutions.)

Single-family homeowners saw their property taxes rise on average by 5.4 percent in 2020, to a nationwide total of $323 billion, reported ATTOM Data Solutions, Irvine, Calif.

The company’s property tax analysis of nearly 87 million U.S. single-family homes showed the average tax on single-family homes in the U.S. in 2020 rose to $3,719 — resulting in an effective tax rate of 1.1 percent. That was up 4.4 percent from $3,561 in 2019, while the effective property tax rate of 1.1 percent in 2020 was down slightly from 1.14 percent in 2019.

“Homeowners across the United States in 2020 got hit with the largest average property tax hike in the last four years, a sign that the cost of running local governments and public school systems rose well past the rate of inflation. The increase was twice what it was in 2019,” said Todd Teta, chief product officer for ATTOM Data Solutions. “Fortunately for recent home buyers, they have mortgages with super-low interest rates that somewhat contain the cost of home ownership. But the latest tax numbers speak loud and clear about the continuing pressure on both recent and longtime homeowners to support the rising cost of public services.”

States with the highest effective property tax rates in 2020 remained New Jersey (2.2 percent), Illinois (2.18 percent), Texas (2.15 percent), Vermont (1.97 percent) and Connecticut (1.92 percent), followed by New Hampshire (1.86 percent), New York (1.68 percent), Pennsylvania (1.64 percent), Ohio (1.62 percent) and Nebraska (1.53 percent).

The lowest effective tax rates in 2020 were in Hawaii (0.37 percent), Alabama (0.44 percent), West Virginia (0.51 percent), Colorado (0.54 percent) and Utah (0.54 percent), followed by Tennessee (0.59 percent), Nevada (0.6 percent), Idaho (0.61 percent), Arizona (0.62 percent) and Wyoming (0.63 percent).

New Jersey had the highest average property tax on single-family homes, $9,196. That was more than 10 times over than the average tax of $841 in Alabama, the state with the lowest average levy. Others states in the top five were Connecticut ($7,395), New York ($6,628), New Hampshire ($6,596) and Massachusetts ($6,514). Others in the bottom five were West Virginia ($849), Arkansas ($1,147), Tennessee ($1,202) and Mississippi ($1,241).

Among 220 metropolitan statistical areas around the country with a population of at least 200,000 in 2020, 12 of the top 20 effective tax rates were in the Northeast. Those with the highest effective property tax rates in 2020 were Syracuse, N.Y. (2.83 percent); Trenton, N.J. (2.69 percent); Binghamton, N.Y. (2.67 percent); El Paso, Texas (2.66 percent) and Rockford, Ill. (2.62 percent).

The lowest rates in 2020 were in Honolulu (0.36 percent); Daphne-Fairhope, Ala. (0.37 percent); Montgomery, Ala. (0.38 percent); Tuscaloosa, Ala. (0.39 percent) and Colorado Springs, Colo. (0.42 percent).