ATTOM: 2022 Single-Family Property Taxes Up 4%

Property taxes on single-family homes grew 3.6% last year, more than double 2021’s 1.6% growth rate, reported ATTOM, Irvine, Calif.

The ATTOM 2022 Property Tax Analysis said $339.8 billion in property taxes were levied on single-family homes last year, up from $328 billion in 2021. Though more than double the 1.6 percent growth in 2021, the final figure was significantly smaller than the 5.4 percent increase seen in 2020.

“Property taxes continued their never-ending climb last year, with wide disparities continuing from one area of the country to another, connected to varying costs, services and tax bases,” said ATTOM CEO Rob Barber. “But, on balance, the latest increase nationwide again was modest.”

Barber noted local governments and school systems will face even greater challenges keeping taxes in check this year given rising inflation rates and a growing number of commercial properties that could be eligible for tax reductions after suffering a surge of vacancies during the pandemic.

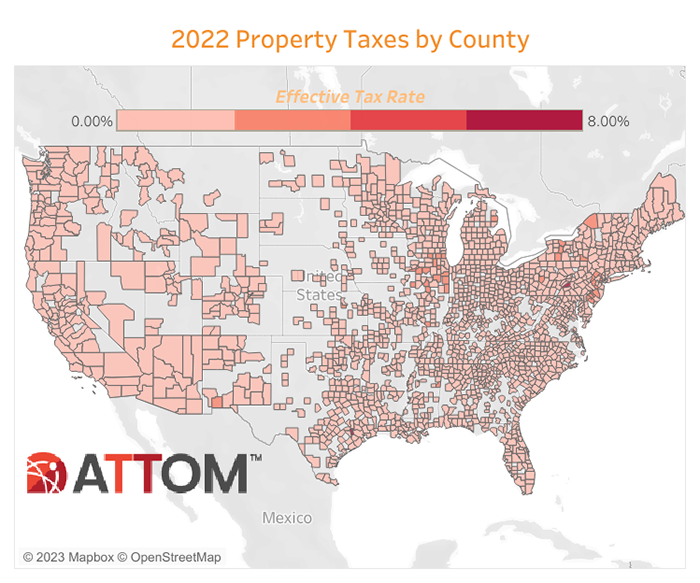

ATTOM analyzed 87 million U.S. single-family homes for the report and found an effective tax rate nationwide of 0.83 percent, down slightly from 0.86 percent in 2021 and the lowest point since at least 2016.

“In 2022, effective rates continued to decline even as total taxes rose because home values went up faster than taxes yet again around the country last year,” the report said. “Despite a stall in the nation’s decade-long housing market boom in 2022, the average single-family home estimated value still rose 7.9 percent over the year. That surpassed the average tax increase, resulting in the small dip in effective rates.”

But that downward trend in effective rates could easily reverse if a drop in home values that began in the second half of last year continues, ATTOM said. Prices have started to decline amid mortgage rates that have doubled, high consumer price inflation and other forces that have cut into what home seekers can afford.

States with the highest effective property tax rates last year included New Jersey (1.79 percent), Illinois (1.78 percent), Connecticut (1.57 percent), Vermont (1.43 percent) and Nebraska (1.36 percent).

The lowest effective tax rates in 2022 were found in Hawaii (0.30 percent), Alabama (0.37 percent), Arizona (0.39 percent), Colorado (0.40 percent) and Tennessee (0.42 percent), ATTOM reported.