There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

Tag: Mortgage Servicing

Sponsored Content from ServiceLink: How Technology Plays a Vital Role in Property Disposition

ServiceLink’s Ryan Helms, product manager, explains how new technology is poised to help servicers and investors make better decisions on how to manage their default portfolios.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

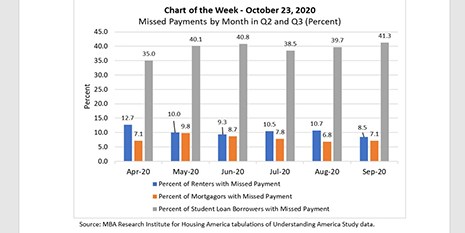

MBA Chart of the Week: Missed Payments By Month (Q2-Q3)

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.