MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

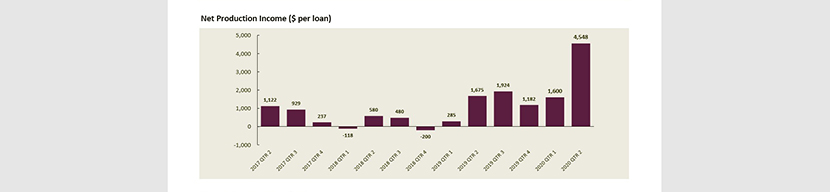

(Chart from MBA Quarterly Mortgage Bankers Performance Report.)

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

Fueled by a surge in borrower demand and record-low mortgage rates, mortgage production profits in the second quarter reached the highest level since inception of the report in 2008. Production volume averaged more than $1 billion per company. MBA reported an “ideal combination” of higher revenues and lower costs; revenues climbed by 57 basis points from the first quarter, while expenses improved by $844 per loan. Productivity also increased, reaching levels not seen since 2012.

However, Marina Walsh, MBA Vice President of Industry Analysis, noted servicing profitability took a hit last quarter. “Mortgage servicing right markdowns and amortization continued, and there was a loss of servicing income from elevated default activity,” she said. “Despite these servicing losses, 96 percent of firms in the report posted overall profitability for the second quarter.”

Key report findings:

• Average pre-tax production profit jumped to 167 basis points in the second quarter, up from an average net production profit of 61 bps in the first quarter.

• Average production volume rose to $1.02 billion per company in the second quarter, up from $728 million per company in the first quarter. Volume by count per company averaged 3,631 loans in the second quarter, up from 2,654 loans last quarter.

• Total production revenue (fee income, net secondary marking income and warehouse spread) increased to 429 bps in the second quarter, up from 362 bps in the first quarter. On a per-loan basis, production revenues increased to $11,686 per loan in the second quarter, up from $9,582 per loan in the first quarter.

• Net secondary marketing income increased to 341 bps in the second quarter, up from 283 bps in the first quarter. On a per-loan basis, net secondary marketing income increased to $9,355 per loan in the second quarter from $7,548 per loan in the first quarter.

• Purchase share of total originations, by dollar volume, decreased to 39 percent in the second quarter from 52 percent in the first quarter. For the mortgage industry as a whole, MBA estimated purchase share at 37 percent in the second quarter.

• Average loan balance for first mortgages increased to a new study high of $282,309 in the second quarter, up from $276,291 in the first quarter.

• Average pull-through rate (loan closings to applications) rose to 71 percent in the second quarter, up from 67 percent in the first quarter.

• Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses and corporate allocations – decreased to $7,138 per loan in the second quarter, down from $7,982 per loan in the first quarter. From third quarter 2008 to last quarter, loan production expenses averaged $6,548 per loan.

• Personnel expenses averaged $4,992 per loan in the second quarter, down from $5,345 per loan in the first quarter.

• Productivity increased to 3.5 loans originated per production employee per month in the second quarter, up from 2.7 loans per production employee per month in the first quarter. Production employees includes sales, fulfillment and production support functions.

• Servicing net financial income for the second quarter (without annualizing) came in at a loss of $68 per loan, compared to a loss of $171 per loan in the first quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses and gains/losses on the bulk sale of MSRs, fell to $23 per loan in the second quarter, down from $52 per loan in the first quarter.

• Including all business lines (both production and servicing), 96 percent of the firms in the study posted pre-tax net financial profits in the second quarter, up from 78 percent in the first quarter.

The MBA Mortgage Bankers Performance Report series offers a variety of performance measures on the mortgage banking industry and is intended as a financial and operational benchmark for independent mortgage companies, bank subsidiaries and other non-depository institutions. Eighty-two percent of the 348 companies that reported production data for the second quarter were independent mortgage companies; the remaining 19 percent were subsidiaries and other non-depository institutions.

MBA produces five Mortgage Bankers Performance Report publications per year: four quarterly reports and one annual report. To purchase or subscribe to the publications, call (202) 557-2879. The reports can also be purchased on MBA’s website by visiting www.mba.org/PerformanceReport.