MBA NewsLink interviewed GME Enterprises President and CEO Gwen Muse-Evans about mortgage servicing during a pandemic.

Tag: Mortgage Servicing

Servicing View from the C-Suite: A Conversation with Gwen Muse-Evans

MBA NewsLink interviewed GME Enterprises President and CEO Gwen Muse-Evans about mortgage servicing during a pandemic.

Servicing View from the C-Suite: A Conversation with Gwen Muse-Evans

MBA NewsLink interviewed GME Enterprises President and CEO Gwen Muse-Evans about mortgage servicing during a pandemic.

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

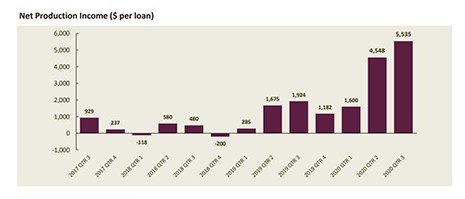

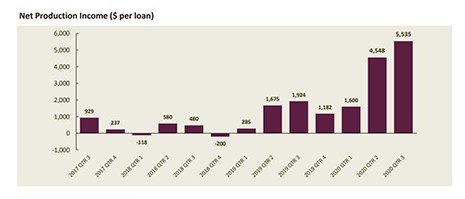

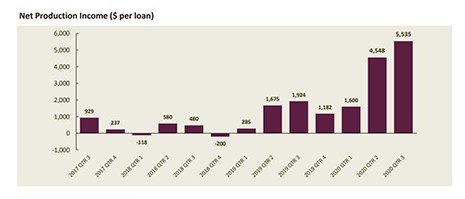

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

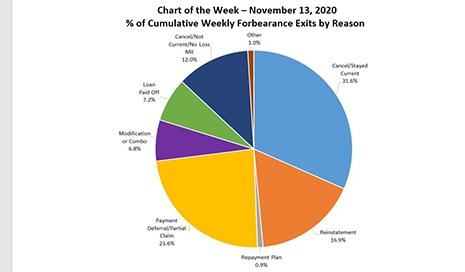

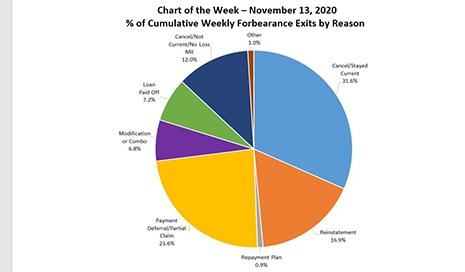

MBA Chart of the Week: Percentage of Cumulative Weekly Forbearance Exits by Reason

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 5.67 percent of servicers’ portfolio volume as of November 1 — well below its peak of 8.55 percent as of June 7.

MBA Chart of the Week: Percentage of Cumulative Weekly Forbearance Exits by Reason

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 5.67 percent of servicers’ portfolio volume as of November 1 — well below its peak of 8.55 percent as of June 7.