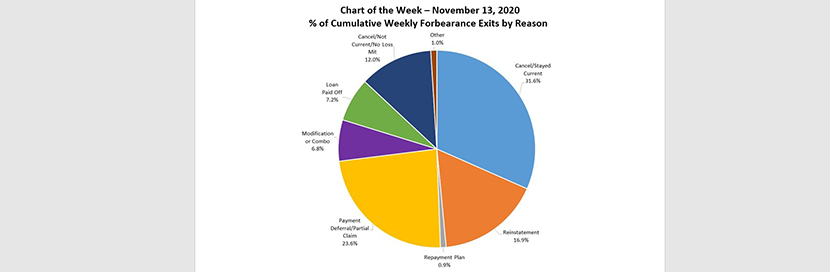

MBA Chart of the Week: Percentage of Cumulative Weekly Forbearance Exits by Reason

(Source: MBA Weekly Forbearance and Call Volume Survey.)

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 5.67 percent of servicers’ portfolio volume as of November 1 — well below its peak of 8.55 percent as of June 7.

With this declining forbearance rate, the question becomes what happens next for borrowers exiting forbearance plans? This week’s chart shows the reasons for forbearance exits, based on the cumulative exits from our weekly surveys for the period from June 1 through November 1.

Of the cumulative weekly forbearance exits thus far:

- 31.6% represented borrowers who continued to make their monthly payments during their forbearance period.

- 23.6% resulted in a loan deferral/partial claim.

- 16.9% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 12.0% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet. These borrowers may need to provide additional documentation to be placed into an appropriate loss mitigation solution or have not made contact with their servicer to extend forbearance or pursue alternatives to foreclosure.

- 7.2% resulted in loans paid off through either a refinance or by selling the home.

- 6.8% resulted in a loan modification or a combination of a loan modification and payment deferral.

- The remaining 1.9% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

Jon Penniman jpenniman@mba.org; Joel Kan jkan@mba.org.