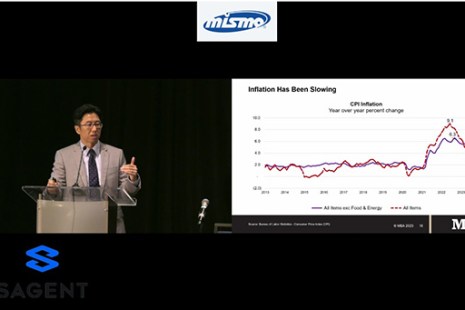

WASHINGTON–The Federal Reserve has made progress in fighting inflation, but high mortgage rates are still distorting the market, MBA Vice President and Deputy Chief Economist Joel Kan said here at the MISMO Fall Summit.

Tag: Mortgage Rates

MISMO Summit: What MBA Economists Expect

WASHINGTON–The Federal Reserve has made progress in fighting inflation, but high mortgage rates are still distorting the market, MBA Vice President and Deputy Chief Economist Joel Kan said here at the MISMO Fall Summit.

Zillow: Homeowners With Low Mortgage Rates Much Less Likely to Sell

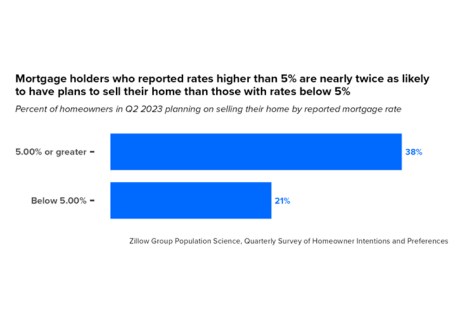

Zillow, Seattle, reported in a new survey that homeowners who have mortgage rates below 5% are nearly twice as likely to want to stay in their current home as those with rates above that threshold.

MBA Chart of the Week Jan. 13, 2023: Mortgage-Treasury Spread

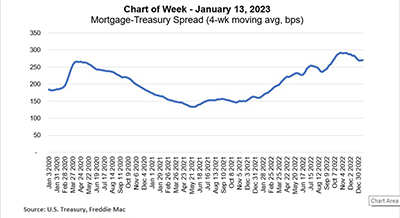

This week’s MBA Chart of the Week looks at the spread of mortgage rates relative to Treasury yields. This has been one of the more puzzling aspects of the current environment and a contributor to the rapid rise in mortgage rates over the past year.

Staying Put: 85% of Homeowners with Mortgages Have Rate Far Below Current Level

With mortgage interest rates pushing well above 6 percent—the Mortgage Bankers Association on Wednesday reported 30-year rates up by 24 basis points to 6.25%–a growing number of homeowners are reluctant to sell because they have a lower rate locked in, said Redfin, Seattle.

Michael Rappaport of Homespire Mortgage: Prevailing Winds–3 Predictions for the Year Ahead

Based on current data and trends, here are three predictions for the industry’s landscape as we move further into 2022.

Ritesh Singhania: Mortgage Rate Buy-Down Points–to Sell or Not to Sell?

Consumers should be informed and aware that, even after the rate on their loan is locked and before it

closes, they have the option to move up and down the rate stack (as above) that was originally used to

lock their loan.

Mortgage Rates Fall to Record Low

The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

Mortgage Rates Fall to Record Low

The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

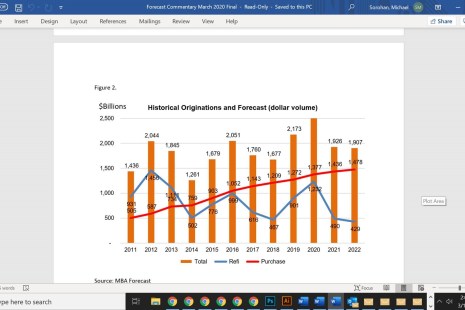

MBA Doubles 2020 Refinance Forecast

The Mortgage Bankers Association this week issued its revised Mortgage Finance Forecast and Economic Forecast, in which MBA doubled its previous 2020 refinance mortgage originations projections.