Zillow: Homeowners With Low Mortgage Rates Much Less Likely to Sell

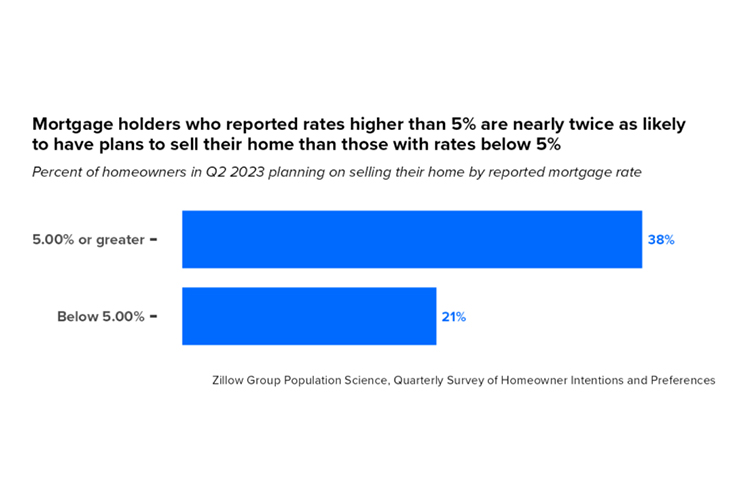

Zillow, Seattle, reported in a new survey that homeowners who have mortgage rates below 5% are nearly twice as likely to want to stay in their current home as those with rates above that threshold.

Mortgage rates have seen serious fluctuations over the past few years, from sub-3% rates in 2020 and 2021 to current rates around 6-7%. According to Zillow’s survey, about 90% of mortgage holders currently have a rate lower than 6%, 80% have a lower rate than 5% and about a third have a rate below 3%.

This environment is contributing to the lack of housing supply, as so many homeowners are disincentivized to sell their homes and move, only to pay so much more a month. For example, 41% of homeowners with a current rate between 5-5.99% are considering selling, but only 26% of those in the 4-4.99% range feel the same way.

Of homeowners who report plans to sell, 47% with a mortgage above 5% have already listed their home, compared with 20% of those below.

“We expect mortgage rates may notch down slightly as inflation comes under control, but they are unlikely to return to 5% in the near future,” said Orphe Divounguy, a Senior Economist at Zillow Home Loans. “That means many homeowners will move only for major life events, like a new baby or retirement. Over time, homeowners will likely accept higher rates as the new normal, but until then, the market could remain challenging for home shoppers, who will see fewer options and higher prices.”

Zillow’s analyses use data from the ZG Population Science Quarterly Survey of Homeowner Intentions and Preferences using a repeated cross-sectional design. The Q2 2023 survey was conducted during the first two weeks of June 2023 and included 1,815 homeowner respondents.