MISMO Summit: What MBA Economists Expect

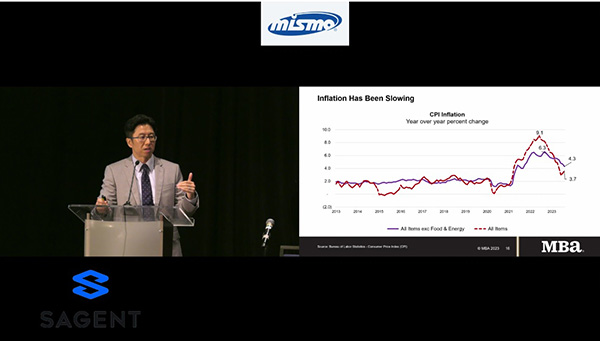

(MBA Vice President and Deputy Chief Economist Joel Kan speaking Monday at the MISMO Fall Summit)

WASHINGTON–The Federal Reserve has made progress in fighting inflation, but high mortgage rates are still distorting the market, MBA Vice President and Deputy Chief Economist Joel Kan said here at the MISMO Fall Summit.

“I want to start with inflation, because I think that’s probably the word that we’ve seen the most in the headlines over the past year or more, whether it’s the Fed or the job market, I think it all really comes down to what prices are doing,” Kan said. “The thing that jumps out is that, historically, the Consumer Price Index measure of inflation growth is around 2%. In 2022, that went to about 9%, which was the highest that we’d seen in about 40 years.”

Kan noted several drivers of inflation. “We had a pandemic, we had disruption in supply chains, we also just had a shift in how we spend money,” he said. “Because of the pandemic, we went from spending money on both goods and services to primarily spending on goods, and if you put that on top of supply chains and distribution and transportation flows that are already disrupted, you have a massive increase in prices, as things just completely got out of balance. This is where the Fed had to step in.”

The Fed watches for price stability as well as employment, Kan said. “They don’t want consumers to change their behavior relative to what they think inflation is going to do,” he noted. “It impacts businesses too, because businesses might say, ‘well, if things are getting more expensive, I need to raise my prices.’ This would make goods and services more expensive. You can see how the cycle goes. So, long story short, the Fed wants to keep inflation stable and somewhat predictable. That requires constant vigilance.”

The Fed Funds rate is one tool the Fed uses to control inflation. “The Fed Funds rate was close to zero in early 2022, then the Fed had to slam on the brakes (when inflation hit 9%), so that rate went from zero to five and a half percent as the Fed tried to cool the economy down,” Kan said. “That makes borrowing more expensive, causing overall economic activity to slow. That usually brings inflation down.”

Kan noted the CPI inflation rate went from 9% last year to about 3.7% In the most recent data. “So we’ve made some progress,” he said.

Looking at mortgage rates, Kan observed they increased from roughly 3% in early 2022 to 7.25% in October 2022. “So within that 10-month period, the refinance business dried up extremely quickly,” he said.

Many homeowners have significant home equity at the moment, “but if someone sitting on a 3% mortgage rate is thinking about cashing out, they’re not going to do it at a 7% rate,” Kan said. “So we have seen little activity on the cash out side, likely just emergency borrowing. In general, people have been looking for other ways to fund remodeling or debt consolidation. You’re not going to see a whole lot of refi activity for a while because we just had two massive years with $4 trillion in originations in 2020 and 2021, when rates were much lower. I think we will reach a point where rates get low enough and people will decide to cash out. But that trade-off has to be much less than it is right now.”

Kan noted MBA’s forecast is for mortgage rates to come down “into the sixes” by the end of this year and in the 5-percent range next year.

Purchase mortgages have also felt the pain of higher rates, Kan noted. “We have two things driving the purchase picture,” he said. “One is affordability, given that you have had such a drastic run-up in rates which reduced purchasing power for many would-be buyers. The other side of that is inventory. Inventory across the country is still extremely tight. We’re down 27% year over year for overall purchase applications, and we know last year wasn’t a great year, either.”

Existing home inventory sits at just under a million units compared to about or just over 2 million units generally, Kan said. “Again, we all know it’s going to take rates coming down some more before people feel like they’re willing to give up their low-rate mortgages [and sell their existing homes],” he said. “The other side of that equation is under building in general. We’ve been under building since the Great Financial Crisis. That’s happening in a lot of the starter home/entry-level home space. We’re relying on younger households to buy those homes, but it’s been difficult for them. And [because interest rates have increased dramatically], you have that lock-in effect that prevents older homes that might be desirable to first-time homebuyers and entry-level buyers from entering the market. So, we need to take care of the inventory issue, obviously, but that’s going to take some time. I think the strength in the new home sales market really is going to help over the next two years or so as we try to kickstart purchase activity again, assuming rates come back down to a reasonable level.”