Truework Founder Ethan Winchell explains why Millennials and Gen Z find homeownership riskier, more stressful, and more expensive than expected.

Tag: Millennials

Millennials Say Financial Barriers Holding Them Back From Homeownership

Three-quarters of Millennials believe homeownership is out of reach for the average person in their generation and 61% say buying a home makes them feel in over their heads financially, according to Clever Offers, St. Louis.

Redfin: Almost One-Quarter of Young Buyers Used Gift or Inheritance in Down Payment

Redfin, Seattle, released a new study finding that 23.8% of Gen Z or millennials who recently bought a home used some form of family money to help fund their down payment.

NAR: Baby Boomers Account for 42% of All Home Buyers

The National Association of Realtors, Chicago, released its 2025 Home Buyers and Sellers Generational Trends report, finding that Baby Boomers were 42% of all home buyers in the past year.

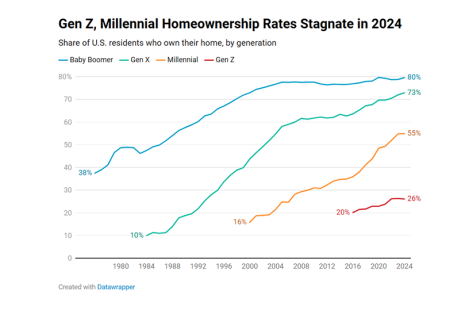

Gen Z, Millennial Homeownership Rates Flat in 2024, Redfin Finds

Redfin, Seattle, found that homeownership rates for Gen Z and millennials were stagnant in 2024.

Jason Dorsey on the Strengths, Trials of a Multigenerational Industry

DALLAS–Housing and mortgage banking is one “of the only industries that ultimately serves every generation,” said Jason Dorsey, a generational researcher and President of the Center for Generational Kinetics, at the Mortgage Bankers Association’s 2025 Servicing Solutions Conference & Expo.

CardRates: Many Young Americans Spending Significantly on Housing

CardRates, Gainesville, Fla., released a survey of millennial and Gen Z Americans, finding 76.32% of respondents are spending more than 31% of their monthly income on housing.

Construction Coverage Analysis: Millennials’ Home Buying Share Varies by State

Construction Coverage, San Diego, released a study finding that millennials accounted for the largest share of home purchases in the Northeast. Topping the list was Massachusetts, where they accounted for 64.2% of home purchase loans in 2023.

Millennials Trying to Save for Homes, but Rent Is Too High, Survey Finds

Lombardo Homes, Shelby Township, Mich., found that while 51% of non-homeowner Millennials say they are saving for a home purchase, 77% say rent is so high it poses a challenge.

‘Sandwich Generation’ Sees Pros, Cons for Home Ownership, Realtor.com Survey Finds

Realtor.com, Santa Clara, Calif., recently conducted a survey that shed more light on the homebuying behavior of the “Sandwich Generation”–Americans who are taking care of their children and aging parents (or sometimes grandparents) simultaneously.