ServiceLink: Millennial, Gen Z Interest in Homebuying High

(Image courtesy of ServiceLink)

ServiceLink, Pittsburgh, released its latest State of Homebuying Report, highlighting significant interest in homebuying from the millennial and Gen Z generations.

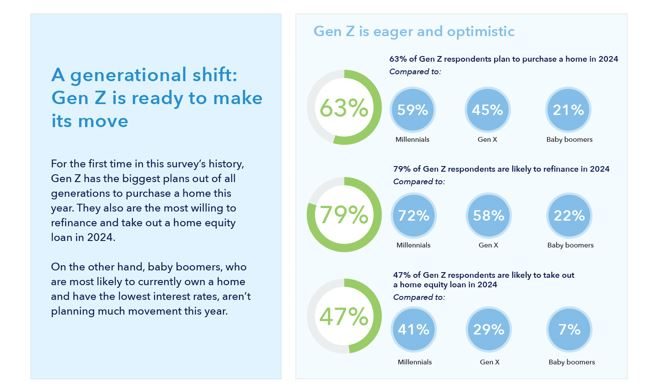

Fifty-nine percent of millennial respondents say they plan to buy a house this year, along with 63% of Gen Z. Only 45% of Gen X and 21% of baby boomers said the same.

“This is an interesting and pivotal moment in the housing and mortgage industries as the younger generations are not only determined to buy but are seemingly undeterred by the higher price tags and interest rates,” said Dave Steinmetz, President of Origination Services, ServiceLink. “Our study suggests that Gen Z and millennials are poised to impact the market in several ways including purchase, refi and home equity, which is an opportunity for lenders to educate and usher these younger buyers through the process.”

Overall, 47% of respondents said they plan to purchase a home this year.

However, 42% also said they considered purchasing one in the last year and then decided against it, down from 49% in last year’s survey. Reasons for changed plans included high mortgage rates (40%), choices were too expensive (40%), financial situation changed (33%), economic and political instability (30%) and that the down payment was too high (29%).

In terms of rates, 15% of respondents who already own their homes say they are unhappy with their interest rate due to it being high.

Demand for home equity products isn’t projected to be as strong–only 28% of homeowners say they plan to take a home equity loan in 2024, down from 44% in 2023.

In terms of refinancing, 57% said they’re either “likely” or “somewhat” likely to refinance this year, given recent years’ spiking interest rates.

Buyers are more open to purchasing homes at auctions–at 54%. That’s up from 40% in 2023 and 33% in 2022. There’s strong interest from younger generations too, with 67% of millennials and 64% of Gen Z saying they’d be willing to purchase a property at auction. Only 55% of Gen X and 29% of baby boomers responded similarly.

In terms of those people likely to try to purchase, they include 44% of people earning less than $50,000, 46% with an income between $50,000 and $99,000 and 51% of those with an income above $100,000.

The highest interest rates individuals will consider also varies by generation. Baby boomers top out at 5% as the highest rate they’d consider; Gen X says 5.8%. But, millennials report 6.2% and Gen Z is at 6.3%.

The survey also explored mortgage technology adoption, finding that baby boomers actually leveraged eSign technology more than the younger generations, with 74% of baby boomers, 58% of millennials, 57% of Gen X and 50% of Gen Z.

Overall, 60% used eSign for documents (up from 48% in 2023), 40% scheduled appraisal or closing digitally (up from 25% in 2023), 50% applied for a mortgage online and 23% conducted their closing virtually.