Millennials Trying to Save for Homes, but Rent Is Too High, Survey Finds

(Image courtesy of Lombardo Homes)

Lombardo Homes, Shelby Township, Mich., recently released a new survey finding that while 51% of non-homeowner Millennials say they are saving for a home purchase, 77% also say rent is so high it poses a challenge.

All the respondents–defined as Millennials between 28-44–are currently non-homeowners.

In addition to high rents posing a challenge, 74% reported debt is inhibiting their savings, with 54% pointing to credit card debt, 40% to student loans, 26% to auto loans and 16% to medical debts.

Generally, the respondents don’t feel ready to be homeowners–58% said if they currently had the money saved, they still wouldn’t feel prepared to make a purchase. However, 75% said they prefer to buy over rent, and 21% said that real estate is the best investment right now. (That was the second most popular answer, after company stocks at 38%.)

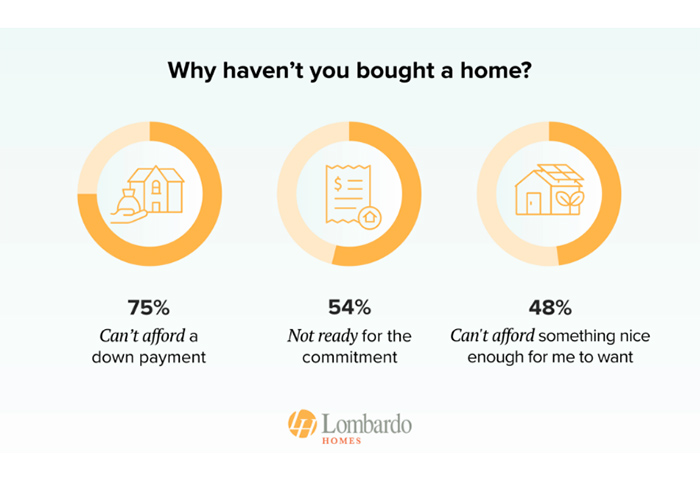

In response to a query of why respondents haven’t bought a home yet, 75% said they can’t afford a down payment, 54% aren’t ready for the commitment and 48% believe they can’t afford the kind of house they want.

Information also poses a challenge. About 40% of respondents overestimated their buying potential–on average by $22,499, the survey found.

Moreover, 47% don’t know what a good percentage for a downpayment would be, 46% don’t have a good sense of the average home price in their area, 43% don’t know what a good interest rate might look like and 23% don’t know if property taxes in the area are high, medium or low.