Millennials Get Comfortable with Mortgage Process

Reports from ICE Mortgage Technology and Zillow illustrate not only how comfortable they have become with the mortgage process—particularly online—but also in what kind of mortgages they obtain.

ICE Mortgage Technology, Pleasanton, Calif., said its monthly Millennial Tracker reported average interest rates for all millennials reached 2.88% in January – the lowest percentage since it began tracking such data in 2016. Older millennials (between 30-40 years old) and younger millennials (between 21-29 years old) took advantage of these low rates in different ways.

The report said older millennials closed more refinance loans in January than their younger counterparts, with refinances accounting for 59% of all closed loans for the cohort, while purchases represented 40%. Conversely, 71% of closed loans by younger millennials were for purchases and 29% of loans were for refinances.

“Although refinances are continuing to grow in popularity for both millennial cohorts, older millennials are still driving the majority of this boom,” said Joe Tyrrell, president of ICE Mortgage Technology. “While some younger millennial homeowners are exploring refinancing, most of this sub-group still remains focused on breaking into the housing market and purchasing their first home.”

Despite the inverse in types of loans closed by older and younger millennials in January, the report said both sub-groups have seen steady consecutive increases in refinance share and decreases in purchase activity since July. In January, refinance share for older millennials increased six percentage points to 59%, up from 53% the month prior. Younger millennials also saw an increase in refinance share from 26% in December to 29% in January.

Younger millennials were also able to secure lower average interest rates compared with their older counterparts. Younger millennials secured an average interest rate of 2.83% across all loan types, while older millennials secured an average rate of 2.89%.

Meanwhile, Zillow, Seattle, reported tech-savvy millennials are not only driving the surfing trend, they could change the way Americans shop for and buy homes. A new Zillow survey found the largest generation of first-time home buyers overwhelmingly want digital tools available during the home shopping process, and many are comfortable purchasing their biggest financial asset online.

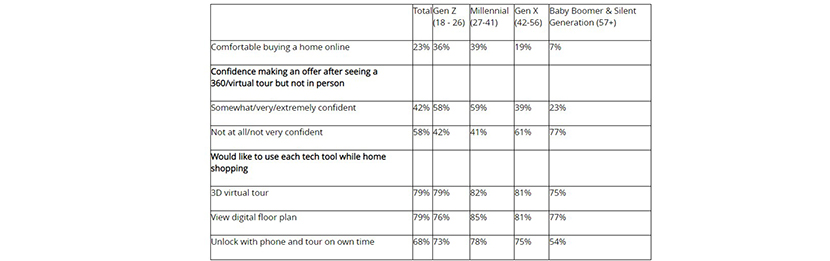

Nearly 40% of millennials (39%) said they would be comfortable buying a home online, and significantly more (59%) said they would be at least somewhat comfortable making an offer on a home after viewing a virtual tour but not touring it in person. But it’s not only homes: Zillow reported millennials are more likely than other generations to say they would be comfortable making many of life’s major purchases online. A large majority — at least 70% — said they would be comfortable buying furniture, appliances, televisions and jewelry online. Nearly half (45%) would be comfortable purchasing a car online.

The report said millennials are more likely than other generations to say they would like to use tech tools while home shopping. More than 80% of millennials would like to view 3D virtual tours (82%) and digital floor plans (85%), and nearly 80% (78%) would like to use self-tour technology to unlock a vacant for-sale home with their phone and tour it on their own time.

“It’s clear that strong demand from the next generation of buyers will keep real estate technology in place long after the pandemic is over,” said Zillow Senior Vice President of Product Matt Daimler. “Digital tools rapidly adopted during the pandemic not only make home shopping safer, they make it faster and easier.

Zillow said time-saving digital tools are allowing millennials, who are often first-time buyers, to compete in a lightning-fast housing market. Homes nationwide are going under contract in a median of 18 days, 28 days faster than a year ago. The pace is even quicker for listings with a Zillow 3D Home tour, which sold, on average, 10% faster, as of May 2020. Virtual tours and interactive floor plans help home shoppers make faster decisions by enabling them to winnow down their options from their couch. Homes on Zillow with a 3D Home tour were saved by buyers 32% more than homes without, and got, on average, 29% more views than listings without.

While millennials are currently the largest adopters of this real estate technology, Gen Z is close behind. More than one in three (36%) zoomers said they would be comfortable buying a home online, compared to 7% of baby boomers and 19% of Gen X. This data signals the coming sea change in how people will likely shop for and buy homes in the not-so-distant post-pandemic future.