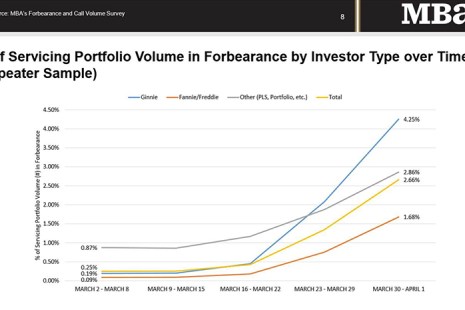

New survey findings from the Mortgage Bankers Association highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

Tag: Mike Fratantoni

MBA April Economic Commentary: Economy Slows Sharply; Massive Job Loss; but V-Shaped Recovery in Forecast

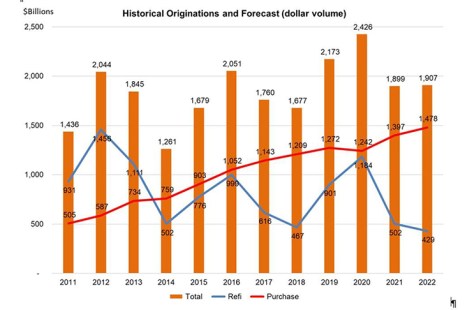

The spread of the coronavirus has slowed global and U.S. economic activity to a halt. Public and private measures to stem the spread of the virus have led to indefinite interruptions in many sectors of the economy, as well as future uncertainty surrounding how long this pause in the global economy will last and what the potential economic losses could be.

First Wave of Employment Losses Smack March Jobs Report

Was it just last month that the nation’s unemployment rate matched a 50-year low? Yes, it was. But that was a lifetime ago in the Age of the Coronavirus.

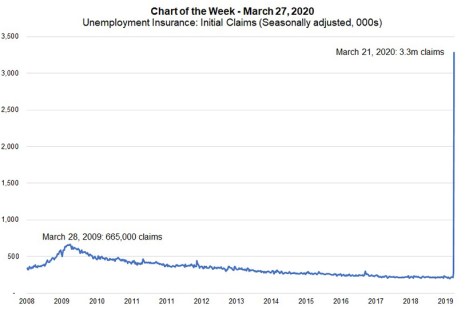

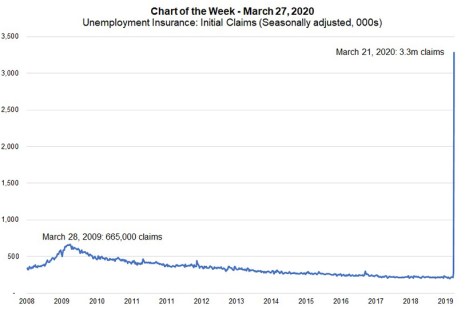

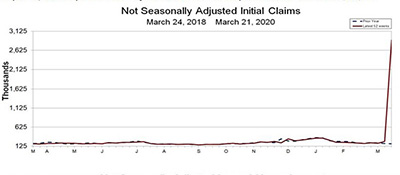

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

For 3.3 Million Americans, Coronavirus Economy Just Got Real

The Labor Department on Thursday said unemployment claims skyrocketed to 3.3 million—the first real indicator of just how potentially devastating the economic effects of the coronavirus can be at the personal and national levels.

CREF Highlights

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

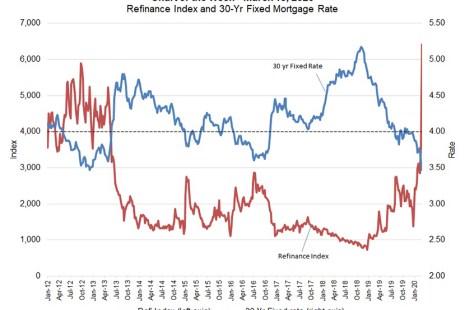

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.

Fed Cuts Interest Rates to Zero; Announces $700 Billion in Stimulus

The Federal Reserve yesterday pre-empted its own regularly scheduled policy meeting this week, announcing an extraordinary full percentage point cut to the federal funds rate and sweeping purchases of government bonds and agency mortgage-backed securities.

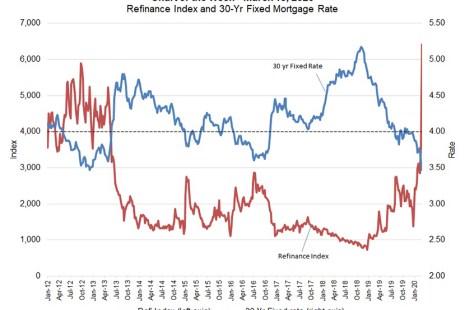

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.