MBA Chart of the Week: Unemployment Insurance/Initial Claims

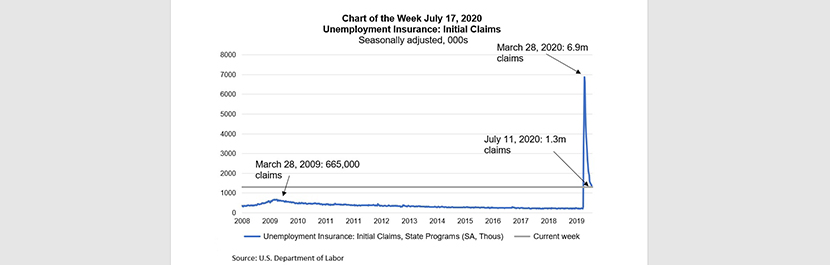

This week’s chart highlights initial unemployment claims data from the U.S. Department of Labor, portraying the speed and severity of the labor market’s deterioration during the COVID-19 pandemic, as businesses closed or transitioned to remote working arrangements.

These data have become prominent in the past few months—it is published every Thursday at 8:30 a.m. ET and thus provides more timely information than the Bureau of Labor Statistics’ monthly employment report.

Each week over the past four months, there have been at least 1.3 million new claimants, the high coming in the week of March 28, when there were a record 6.9 million claims. This was more than 10 times the highest weekly level seen during the Great Recession in 2009. The total number of claims filed over the four-month period stands at 51.3 million. Even with the recent improvement – with claims edging down for 15 weeks – the current week’s level of 1.3 million is about double the 2009 high.

The report also provides data on individuals who filed continued claims, also referred to as insured unemployment. There were 17.3 million insured unemployed in the July 15 release, down from a high of 24.9 million in the second week of May. That is, there have been a record number of hires in recent weeks—as documented in the BLS’ Job Openings and Labor Turnover Survey (JOLTS) July 7 release that reported 6.5 million hires in May.

MBA’s weekly Forbearance and Call Volume Survey findings have revealed that the number of borrowers in forbearance has declined in recent weeks, in line with the gradual improvement in the job market. However, the surge in COVID-19 cases throughout the country in recent weeks presents clouds for the economic outlook. MBA continues to call on Congress to extend enhanced unemployment insurance benefits to support those households that remain unemployed.

Joel Kan jkan@mba.org; Edward Seiler eseiler@mba.org.