For 3.3 Million Americans, Coronavirus Economy Just Got Real

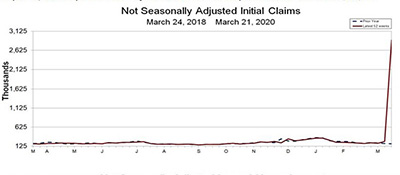

The Labor Department on Thursday said unemployment claims skyrocketed to 3.3 million—the first real indicator of just how potentially devastating the economic effects of the coronavirus can be at the personal and national levels.

For the week ending March 21, the advance figure for seasonally adjusted initial claims jumped to 3.283 million, an increase of three million from the previous week alone and marking the highest level of claims in the history of the report. The previous high was 685,000 in October 1982.

The sheer number of claims skewed four-week moving averages as well, to 998,250, an increase of nearly 766,000 from the previous week.

“Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus,” said Mortgage Bankers Association Chief Economist Mike Fratantoni. “These layoffs will lead to real hardships for millions of households across the country.”

Fratatntoni noted mortgage servicers are already hearing from a substantial number of homeowners who are concerned about their ability to make their mortgage payments on time.

“The mortgage industry is ready and willing to help through the use of established forbearance programs, allowing borrowers who have lost their jobs or been furloughed as a result of the virus the ability to delay their payments for at least six months,” Fratantoni said. “However, the unprecedented and unexpected wave of forbearance requests will place a significant strain on mortgage servicers. Even if a quarter of all borrowers request forbearance for six months or longer, cash demands on servicers could exceed $75 billion and could climb well above $100 billion.”

Fratantoni added it is “absolutely critical” for the Federal Reserve and Treasury to immediately establish a liquidity facility so that otherwise solvent mortgage servicers can borrow from the Fed to support these forbearance programs. “This needed backstop for servicers will ultimately support homeowners during these challenging times,” he said.

Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the sheer scope of the crisis dwarfs other abrupt shocks, such as 9/11 or recent hurricanes.

“We all knew it’d be bad, but the record 3.28 million people filing for unemployment insurance is still an arresting figure, and, like the first glimpse of the big shark, it puts the scope of the crisis in perspective,” Quinlan said. “Today’s report emphasizes not only the magnitude of COVID-19-related job losses, but also the speed at which they occurred. During the Great Recession, nonfarm employment fell peak-to-trough by a total of 8.7 million, but that decline occurred over two years, from January 2008 to February 2010. We are likely to see an even larger number of workers lose their jobs in only a matter of weeks, if not already.”

Quinlan warned the results are “only a prelude of what is to come. The initial factor driving the unprecedented spike is the fact that states and municipalities mandated widespread closures of consumer-facing industries gradually, with some like San Francisco and New York leading the country, and others taking more drastic steps only this week,” he said. “Second, even in the areas with the earliest shutdowns, we suspect many employers initially tried to maintain somewhat normal operations, with restaurants switching to delivery and takeout for example, but have since had to lay off staff after succumbing to drastically lower demand or stricter shelter-in-place orders. Third, many states reported severe backlogs—their systems were simply not designed to process the sheer volume of claims they faced. And fourth, laid-off workers may simply delay their claims a few days or weeks as they deal with a host of other logistical challenges such as school and daycare closures.”

“We interpret this morning’s release as a strong leading indicator of an expected increase in household financial stress,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.

Quinlan said the next few weeks will likely set-up a troublesome March employment report, scheduled for April 3, but not nearly as troubling as the April report slated for early May. “The timing of the survey, which was conducted during the week ended March 14, means that we will likely only see only a moderate fall in employment,” he said. “The April report will bear the brunt of the damage, with job losses expected in the millions, and scope for downward revisions to March as well.”